Legislative staff recommends cutting raises, benefits of state employees just ratified in contract

By Len Lazarick

State employees last Wednesday ratified a new one-year contract that provided 2% raises, regular step increases, health premium holidays and other financial benefits they had been denied in the lean years of the Great Recession.

State employees last Wednesday ratified a new one-year contract that provided 2% raises, regular step increases, health premium holidays and other financial benefits they had been denied in the lean years of the Great Recession.

Two days later, the legislature’s budget staff recommended rolling back about half the negotiated increases, moves that took the largest state union by surprise, calling them “alarming” and “disturbing.”

“We find this budget analysis almost shocking,” Sue Esty, legislative affairs director for Council 3 of the American Federation of State, County and Municipal Employees, told the House Appropriations Committee Friday.

O’Malley Budget Secretary Eloise Foster urged the committee to reject the recommendations and live up to the collective bargaining agreement the administration had negotiated.

Maryland’s legislature is only allowed to cut the governor’s budget, so it is routine for its staff to focus on spending cuts.

Revenue write down

But according to several senators on the Senate Budget and Taxation Committee, Warren Deschenaux, the legislature’s chief budget analyst, has warned them that the official revenue estimates due next week are likely to see a write down of $100 million to $200 million. In particular, the sales tax revenues from December shopping were lower than projected.

This means the state will have even less money to spend than planned in Gov. Martin O’Malley’s $39 billion budget. He had provided a minuscule surplus of only $30 million, along with the continuation of other money-shifting gimmicks that have helped balance the budget in past years.

As part of that search for $150 million to $200 million in budget cuts, the Department of Legislative Services analysis recommended cutting in a half the proposed 2% cost-of-living increase, but beginning it six months earlier. This would lower base salaries in the following budget year.

DLS also recommended delaying step increases by three months, and eliminating two of four “holidays” for health insurance premiums.

The premium holidays, which increase net pay, were based on reductions in health care costs that employees had gained by use of wellness programs, higher co-pays for services and reduced utilization of hospital emergency rooms.

Already fighting pension cut

AFSCME and the teachers union were already fighting Gov. O’Malley’s proposed permanent $100 million cut in funding for their pension systems. In 2011, an additional $300 million contribution had been promised based on the savings produced by pension reform legislation that increased salary contributions from 5% to 7% of pay and reduced future benefits.

“State employees are driving the savings for health insurance and pensions,” Esty said. “But instead of being plowed back into” reducing the liabilities for retirements and other post-employment benefits, particularly health insurance, “they are being used to balance the budget.”

The surplus in the health insurance fund is the “money that was saved by employee behavior,” and should be used to reduce their premiums, not to balance the general fund, Esty said.

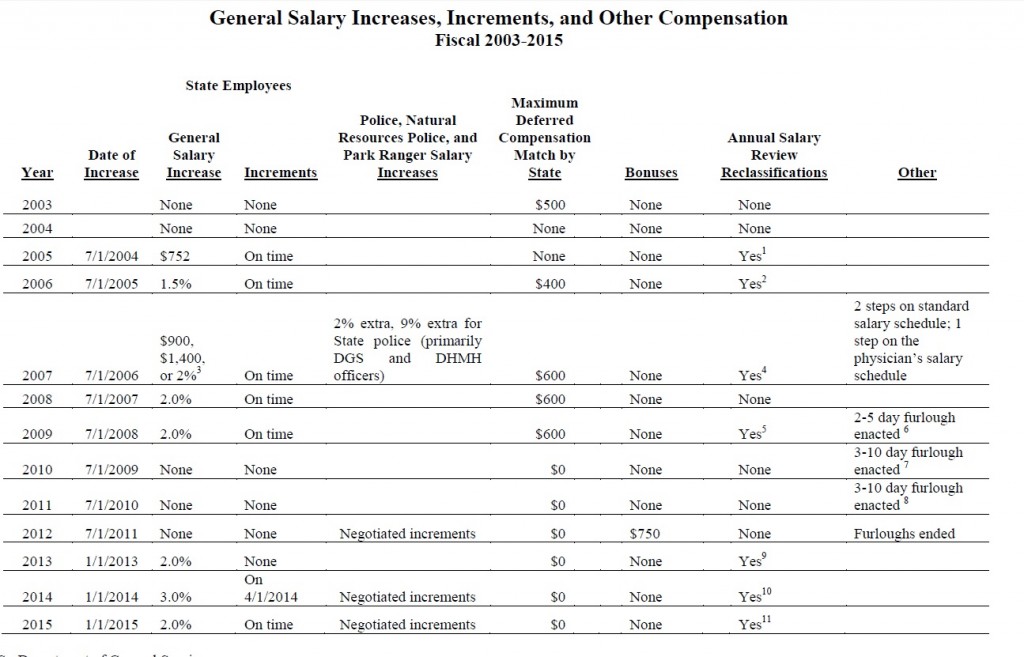

The proposed cuts in the ratified contract were “terrible for morale,” Esty said. This is especially true for recently hired employees who were expecting regular raises, merit increments and a match of deferred compensation, but instead got none of those things as well as temporary pay cuts through unpaid furloughs. The chart below shows the history of pay hikes, increments and other compensation over the past decade.

MarylandReporter.com is a daily news website produced by journalists committed to making state government as open, transparent, accountable and responsive as possible – in deed, not just in promise. We believe the people who pay for this government are entitled to have their money spent in an efficient and effective way, and that they are entitled to keep as much of their hard-earned dollars as they possibly can.