What Is the Backdoor IRA Roth?

Image by Steve Buissinne from Pixabay

Recently, there has been a lot of talk about Congress closing the backdoor Roth IRA. But what is it?

If your salary is too high for a Roth IRA, a back-door Roth IRA allows you to convert a traditional IRA to a Roth IRA. People with higher salaries might use a back-door Roth IRA to avoid income limitations.

The backdoor Roth IRA is just some clever administrative work: contribute to the standard IRA, change your contributions to the Roth IRA, handle taxes, then you’re finished.

Even if you are not eligible for the Roth IRA, you can still contribute through the back door, regardless of your salary.

That’s excellent news since your money will grow tax-free. It is a great benefit when it becomes time to withdraw it when you retire.

What is the backdoor Roth IRA?

The Roth IRA or Roth 401(k) is a retirement savings plan that allows taxpayers to set aside a portion of their earnings each year. The funds deposited are after-tax funds. The income earned on those profits is paid in the year the funds are deposited.

This contrasts with a standard IRA or 401(k), which provides an immediate tax benefit by deferring income taxes on contributions until the funds are withdrawn. Instead, the now-retired account holder will face taxes on both the cash invested and the earnings when they make withdrawals.

The issue is that persons who earn more over a certain amount are not allowed to create or fund Roth IRAs—at least not under the current regulations.

How to open the Roth IRA through the back door

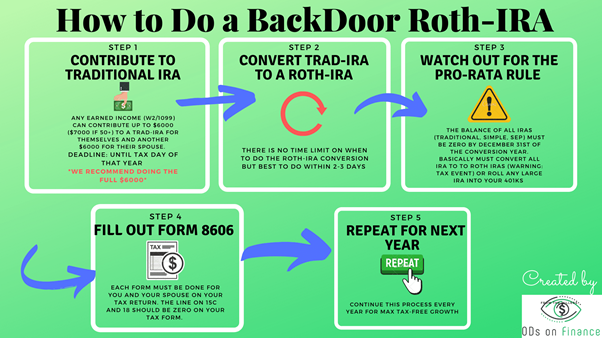

A guide to converting a back-door Roth IRA:

- Set money aside in a regular IRA. You may already have an account or need to establish and fund one.

- Invest in the Roth IRA by converting your contribution. Your Roth IRA administrator will send the instructions and paperwork. If you do not already have an IRA during the conversion procedure, you will create one.

- Get ready to pay the taxes. Roth IRAs are only funded using after-tax money. If you selected to deduct traditional Roth IRA contributions and subsequently converted your traditional IRA to a back-door Roth, you would have to forfeit that tax benefit. So prepare to pay the income tax on your money converted to the Roth when it’s time to submit your tax return. Also, read below for more information on the pro-rata rule, which has a significant impact on your taxes.

- Have a plan to pay taxes on your conventional IRA profits. For example, if your money in the traditional IRA was lying there for a while and there have been investment gains, you will owe a charge on those profits when tax season rolls around.

Why should I open a backdoor Roth IRA?

Why would taxpayers want to go to the trouble of executing the back-door Roth IRA dance, other than getting around the limits?

- For one thing, Roth IRAs have no required minimum distributions. Therefore, your account balances can grow tax-deferred for as long as the account holder lives. You may take as much or as little money out, or you can leave it entirely to your heirs.

- Another reason is that Roth IRA distributions are not taxed, unlike regular IRA distributions. Therefore a back-door Roth contribution might result in considerable tax savings over time. Even if you make too much money to qualify for the Roth IRA, you may still want to do so for the tax benefit of being able to withdraw assets tax-free in retirement. This is especially important if you anticipate retiring at a higher tax rate than today. Furthermore, the Roth IRA has no required minimum distributions, and you can even leave it alone and leave it to a successor.

- The real benefit of a back-door Roth IRA, like other Roths, is that you pay taxes on your converted funds upfront, and everything after that is tax-free.

What are the rules for backdoor Roth IRAs?

To avoid fines, remember the following rules:

Transfers of many kinds

Any of the below conversions is required:

- A rollover, in which the funds are received from your Roth IRA and deposited into your Roth IRA account within sixty days,

- A transfer from one trustee to another trustee, in which case the Roth IRA provider distributes the funds to your Roth IRA provider directly, or

- An Equal trustee transfer, where funds are transferred from an IRA to the Roth account at the same banking institution.

The Rule of Pro-Rata

Rollovers from conventional IRAs to Roth IRAs must be done pro rata, according to the IRS. The following is how it works: The IRS will consider all your traditional IRA accounts when calculating your tax obligation with a conversion from a standard IRA and change to the Roth IRA.

If you have 70% pre-tax money in all the conventional IRAs and 30% after you pay taxes on the funds in all the Roth IRAs, that ratio affects how much of the money you convert to the Roth will be taxed.

You cannot convert merely after-tax funds since the IRS will not let you. Here is an additional note on timing: the IRS does apply the rule for pro rata to the entire IRA amount at the end of the year, not at the beginning.