Former RNC chair says Trump’s Big Beautiful Bill is a ‘killer’ for Republicans

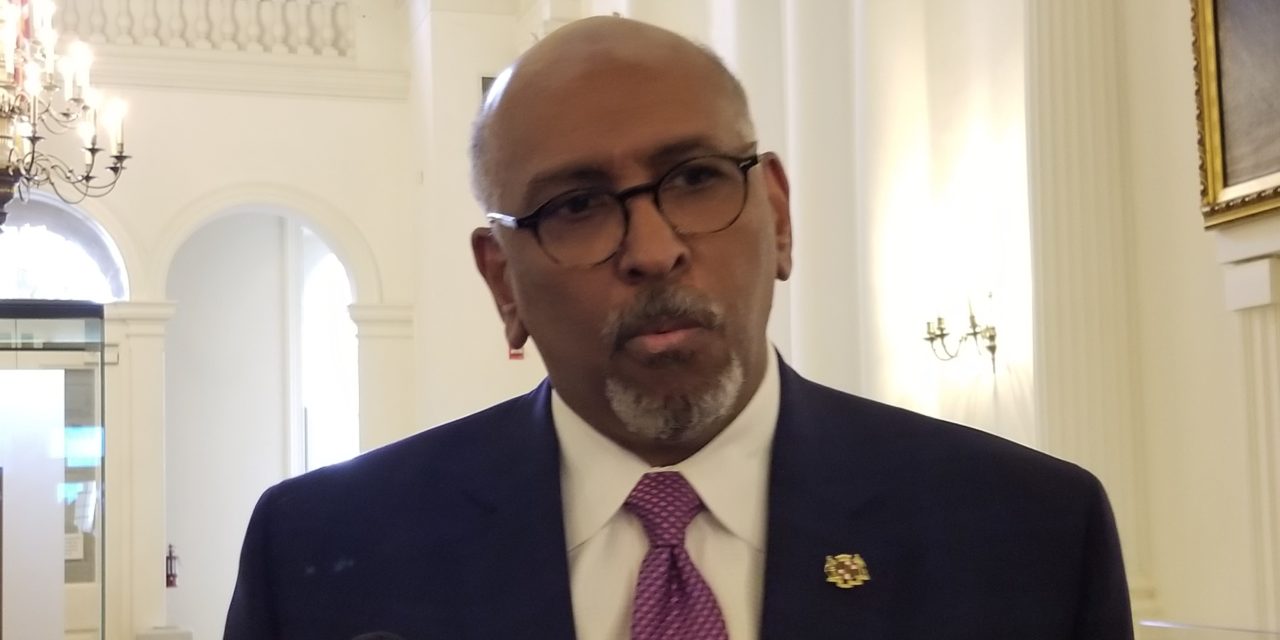

Former Republican National Committee (RNC) chair and former Md. Lt. Gov. Michael Steele said support for the $4.5 trillion tax cut bill President Donald Trump signed into law earlier this month is not likely to help GOP lawmakers in the 2026 midterm elections.

“It’s a killer,” Steele, a frequent critic of the president, told Baltimore Post-Examiner in an exclusive interview earlier this week.

Steele said it makes good political sense why many of the bill’s key provisions do not take effect until a later date.

“There is a reason why Republicans passed a massive $3 trillion increase to our nation’s debt, made permanent cuts that benefit the wealthiest Americans, and cut Medicaid by almost a trillion dollars,” Steele said. “There is a reason why they have all of that go into effect after the midterm elections. Because they don’t want to talk about or tell people what they did to them during next year’s campaign.”

Todd Eberly, a professor of political science at St. Mary’s College of Maryland, also said the legislation could hurt the GOP.

“It’s hard to see the legislation helping Republicans in 2026,” Eberly said. “The President’s approval rating is hovering around 40%, which only adds to the GOP’s woes. And now, instead of going home for the August recess to try and tout the legislation, the furor over the Epstein files is stealing all of the oxygen in the room. Republicans delayed implementation of most of the Medicaid cuts until AFTER the 2026 midterms in an effort to minimize any fallout, but most of the tax provisions merely maintained current tax rates, so many voters won’t see any appreciable benefit in their paycheck. Even the no tax on tip provision will have limited impact given that many tipped workers earn so little that they don’t pay federal income taxes.”

Richard Vatz, a professor emeritus of political persuasion, who taught at Towson University for almost five decades, cast doubt on whether the bill will actually hurt Republicans’ chances of maintaining control of Congress.

“Some of the reasons that the effects cannot be known are that it is impossible to link voting to particular items in a bill,” Vatz said. “In addition, there are so many intervening variables that there is no way to control for the bill’s effects. If we are not at war, if we have little or no increase in inflation, if there are no overriding issues to erase the incredibly foolish and destructive Democratic border policies of 2021-2024 and their inexplicable support for biological men participating in women’s sports, on what issues could Democrats reverse the 2024 outcomes in the House, Senate or even local races?”

The One Big Beautiful Bill Act (OBBA) makes permanent some of the tax cuts contained in the 2017 legislation Trump signed in his first term in office (2017-2021).

Many of those cuts were scheduled to expire at the end of next year.

OBBA keeps the maximum corporate tax at 21% and the top personal income tax bracket at 37%. It exempts estate taxes for wealth transfers up to $15 million per individual. Though many states, including Maryland, tax estates worth substantially less than that.

The legislation cuts Medicaid by about $1 trillion and sets up work requirements for those receiving assistance.

It provides slight increases in allowance for both the standard deduction and for child tax credits. It eliminates taxes on tips and overtime pay and places lifetime caps on student loan borrowing.

State and Local Tax (SALT) deductions increase to up to $40,000 in 2025 for taxpayers below a certain income threshold. However, by 2030, SALT deductions return to a maximum of up to $10,000.

How does the bill affect lower- and middle-income earners?

Steele noted that Republicans have proposed legislation to protect Medicaid from additional cuts and said that there is clear evidence that the party is beginning to worry about possible political ramifications.

“This is bad business for the country. It is bad economics for the American people. And it is bad politics for the Republican Party.”

Steele reiterated that it may take some time before voters see how the legislation affects them, as is the case with Trump’s tariff regime.

“We are living in a space now where products are on shelves and prices are not as high as they could have been or would have been. Because manufacturers placed massive orders. But their stockrooms can only hold so much inventory. That inventory is now becoming depleted. Those tariffs are just sitting there. And the cost is going to become real very soon.”

Eberly said the lack of broad public support for the legislation further compounds an already difficult situation for Republicans.

“The average seat loss for the president’s party in a midterm is 28 seats,” Eberly said. “So it’ll likely be very difficult for the GOP to hold onto its slim majority. Passing a widely unpopular bill is unlikely to reverse that historical average. Does it help or hurt the middle class? The bottom 40% of income earners can expect to save $150-$750 a year in taxes, as compared with over $12,000 for the top 20% of earners. So, the tax benefits, including the SALT deduction, are skewed toward the more well-off. Then there’s the public relations problem of the over $3 trillion it’s expected to add to the debt over the next 10 years. I think it’s going to be hard to turn public opinion around on the bill.”

At this point in time, Vatz said it may be a mistake for Democrats to start to believe that they have the upper hand in the midterms.

“There is a tendency for the party in opposition to the party in control of the White House and both the House and Senate to come back, and it is possible,” Vatz said. “To say it is likely is a fool’s judgment…I am not pessimistic about the mid-term elections. Unity doesn’t answer everything, but manifest disunity hurts Democrats and may well destroy their prospects in 2026.”

So, where does that leave things?

Steele said that unlike previous tax cuts enacted under GOP Presidents Ronald Reagan and George W. Bush, OBBA makes little attempt to cut spending while decreasing revenue and sooner or later, voters will feel the pinch as the debt grows even further out of control.

“There is no balancing here,” Steele said. “You are just giving the benefit to a very small portion of Americans on the idea that somehow they are going to take that largess you’ve just given them and turn it over to the American people. How? No! They are going to put it into things that they want for themselves. They are going to invest it in their companies and sock it away. They are not going to pile it back into the economy and make sure some poor person in Mississippi has a future. That is just not how it works.”

Bryan is the managing editor of Baltimore Post-Examiner.

He is an award-winning political journalist who has extensive experience covering Congress and Maryland state government. His work includes coverage of the first election of President Donald Trump, the confirmation hearings of Supreme Court Justice Brett Kavanaugh and attorneys general William Barr and Jeff Sessions, the Maryland General Assembly, Gov. Larry Hogan, and the COVID-19 pandemic.

Bryan has broken stories involving athletic and sexual assault scandals with the Baltimore Post-Examiner.

His original UMBC investigation gained international attention, was featured in People Magazine and he was interviewed by ABC’s “Good Morning America” and local radio stations. Bryan broke subsequent stories documenting UMBC’s omission of a sexual assault on their daily crime log and a federal investigation related to the university’s handling of an alleged sexual assault.

There is a lot of positive inspiration in your article, which has inspired me to write more about this topic. Very inspiring.

Interesting. I’m having a problem related to this. Luckily, I found this page. It’s a good reference for me. Thanks.

Michael Steele sold out his values to become an MSNBC grifter hack. Everybody has their price, I suppose. He’s not worth listening to about anything.

Hey Roderick, what’s “toost”? Some kind of new Dutch pastry?

Republicans are toost and only the blindly loyal can’t see it. American voters aren’t stupid.