Missing the Point – A government addicted to debt

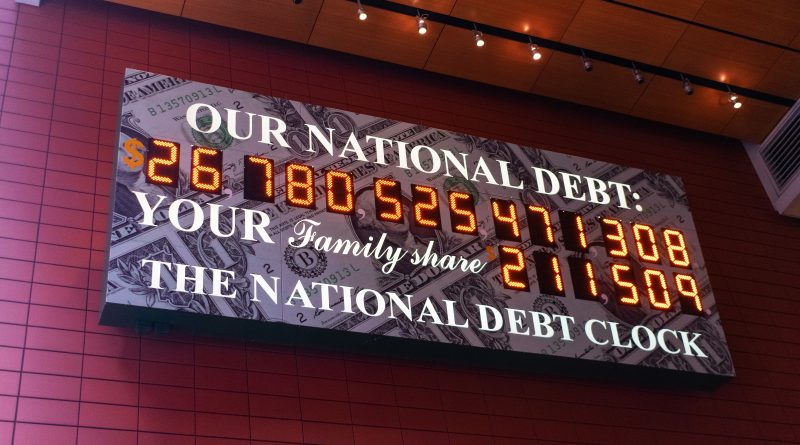

The last time I checked, our total outstanding national debt was $31.7 trillion. That’s “trillion,” with a “t.” A trillion is one thousand billion. $31.7 trillion is roughly $95,000 per American, babies and centenarians included. The current debt – and the interest we owe on it – will no doubt be significantly larger by the time you read this.

And so, it’s that time of the year again. The administration has proposed a budget calling for zillions of dollars of expenditures that are kuh-billions more than the tax revenues our government collects. Notice that I’m avoiding using actual dollar amounts because numbers are boring and are, in this case, so big as to be hard to comprehend. You can thank me later.

The difference between those two amounts – between how much we’re going to spend and the revenues our government collects is the “deficit.” How do we cover that deficit? Well, regardless of what some people think, our government can’t just print money to pay our bills. No. We have to borrow the difference. If we don’t, our government won’t be able to pay its obligations which, trust me on this, is not a good thing. Not a good thing for people, for companies, or for countries – and for the United States, in particular, given who we are globally.

And so, the President and most Democrats in Congress need to raise the debt ceiling to enable the government to borrow the money it needs. The Republicans, who insist on always being on the other side of every argument whether or not they have a position that makes any sense, refuse to cooperate unless the Democrats agree to reduce spending, trashing some of their favorite programs. The Republicans don’t have any better ideas of their own, but holding the country hostage gives them the leverage they can’t accomplish otherwise, intellectually or politically.

This argument continues until somebody blinks because neither party has a vested interest in owning a national default. Unfortunately, what neither party has the courage to do is ask why our government has become addicted to debt and what can we do to get over it.

Immediately, there will be politicians and economists who will argue that my problem is that I’m thinking like a household or company while the government is neither. That the government isn’t constrained by debt the way people and businesses are. Well, that’s nonsense. I feel like apologizing for being so direct, but I won’t because the point they’re trying to make is ridiculous. The government is a company that is in the business of providing services to the people who are its customers. Not incidentally, we, the people, are also the owners of this government company.

Why do companies borrow money? For two reasons… To invest in their development and growth and to survive during temporary periods when revenues are below what they need to cover their expenses. On the downside of business cycles, for example, until the economy recovers. How much debt they carry, on a sustained basis, depends upon the cost of servicing that debt relative to revenues and other expenses in good and bad times. That is, of course, a casual observation for the sake of discussion that wildly over-simplifies the reality in which households, companies, and governments operate.

Our government’s problem is that it – and here is how it differs from its household and corporate counterparts – has allowed the way it views debt to be limited by political considerations. As you and I are well aware, there are actually three ways to fund a deficit. We can spend less, borrow money, and/or endeavor to make more money. Same for companies. By comparison and for political – not economic or financial reasons – the government has taken increasing revenues, better known as “taxes,” off the table. And that’s because the decision makers – Congress and the President – don’t want to do anything that annoys the people who elected them.

As far as Congress is concerned, if there is a deficit, the only solutions are to either reduce expenditures or borrow the money to cover the shortfall. Almost never ever do they think seriously in terms of increasing revenues. And that’s our problem. Not that we will or won’t raise the debt ceiling, because we will, albeit at the last moment, but that we’ve become addicted – as a government and people – to borrowing the money we need to fund our government instead of paying for government services as we go.

Is addiction to debt inherent in the DNA of capitalism? No. Of the fifty-two countries with the highest national debt as listed by World Population Review, the United States is in first place by dollars owed, but then that’s not surprising because we’re a large country with the world’s leading economy. We are, however, ranked fourteenth in the world by national debt as a percent of Gross Domestic Product (GDP) which is the value of the final stage goods and services we produce over the course of a year. And only third in the world by national debt per capita, behind only Singapore and Japan. But then – and this is the punchline – we’re forty-third in the world when ranked, in descending order, by personal income tax rates.

That’s right. Among the list of fifty-two countries with the highest national debt, forty-two of them have higher income tax rates, many of them much higher. We’re a highly consumer demand-driven economy whose people have more disposable income as a percentage of total income than most of the developed and other major countries in the world. Now, I know that sounds like a good thing, but that’s only until you realize that one of the ways we’ve accomplished that wonderland of consumer spending is by under-funding our government.

“So what?” you’re asking yourself.

The problem is that our government keeps borrowing, without, for the most part, periodically reducing total debt when times are good. More importantly, we keep borrowing, as if the cost of servicing that debt – the interest we pay on it – isn’t already a major expense that we need to borrow to cover. Sounding a lot like a Ponzi scheme, isn’t it? Or like a struggling household using one credit card to make payments on the balance it has on another one. Is that really what our government has become?

And we keep borrowing with reckless disregard for how we might better spend all that interest we’re paying – on the $31.7 trillion we owe. FYI, according to the Congressional Budget Office, we paid $475 billion in interest on the national debt in fiscal 2022. We’re projected to spend $640 billion in fiscal 2023, $739 billion in fiscal 2024, and a whopping $1.429 trillion in interest alone on the national debt in 2033, just ten years from now.

“Wow.”

Yeah, and remember that, to a large extent, the interest we’re paying today is on government services we purchased and consumed in the past. To be sure, a lot of it has to do with investments that are producing a return, a “social profit” in a manner of speaking, now and will be beneficial to America in the future, but that’s not the case for all the interest we’re paying on an older debt.

And that gets us back to Congress and The White House arguing over the debt ceiling. Yes, we need to make sure we are spending efficiently on the programs our people need, but then there’s even more that we should be doing to better educate and take better care of all Americans. To be honest, and I say this as someone who pays taxes just like you do, we need to set the politics of taxation aside and increase government revenues by raising taxes – preferably more so for those more fortunate among us who can afford to pay more.

The Republicans aren’t wrong, the Democrats and President Biden aren’t right. They’re all just missing the point – politicians who put political self-interest ahead of what’s best for their constituents.

Nobody likes paying more taxes, but it’s the right and the smart thing to do.

Les Cohen is a long-term Marylander, having grown up in Annapolis. Professionally, he writes and edits materials for business and political clients from his base of operations in Columbia, Maryland. He has a Ph.D. in Urban and Regional Economics. Leave a comment or feel free to send him an email to [email protected].