Maryland Comptroller Peter Franchot releases top 50 tax evaders

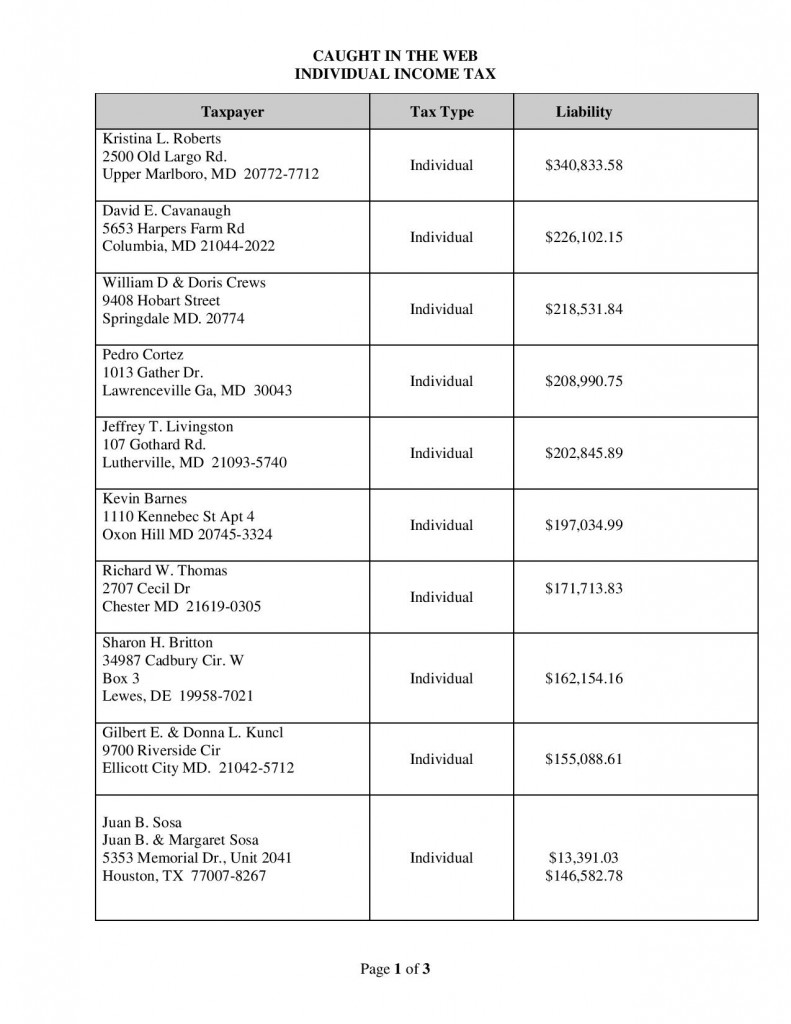

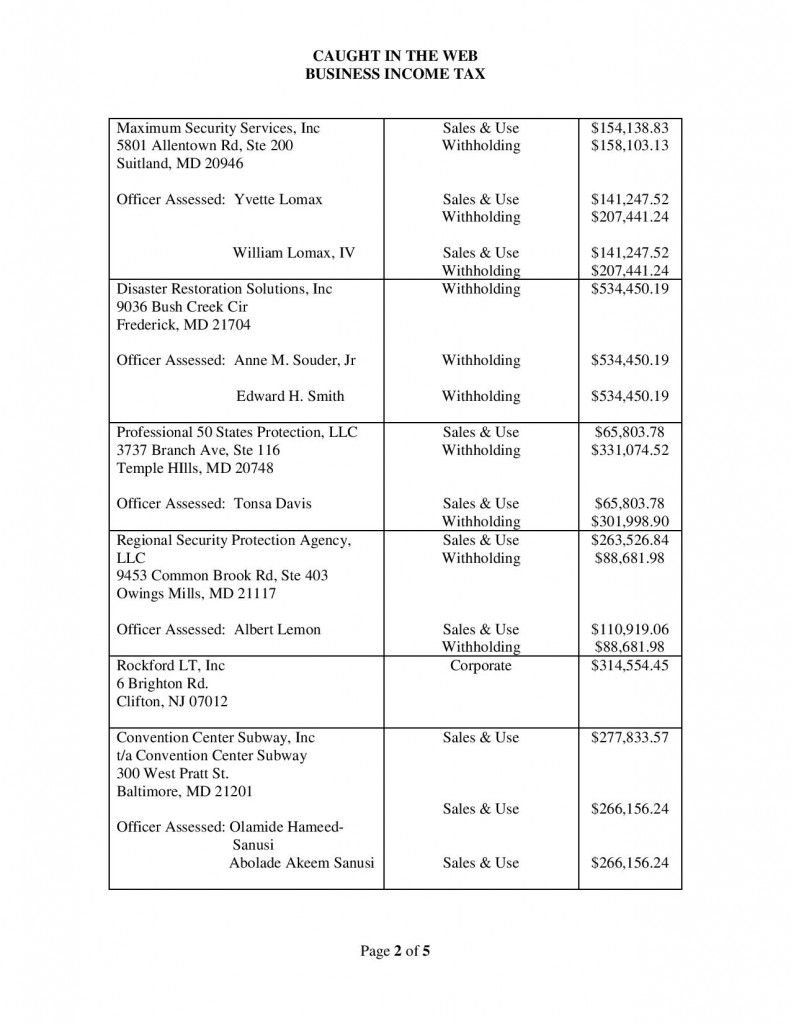

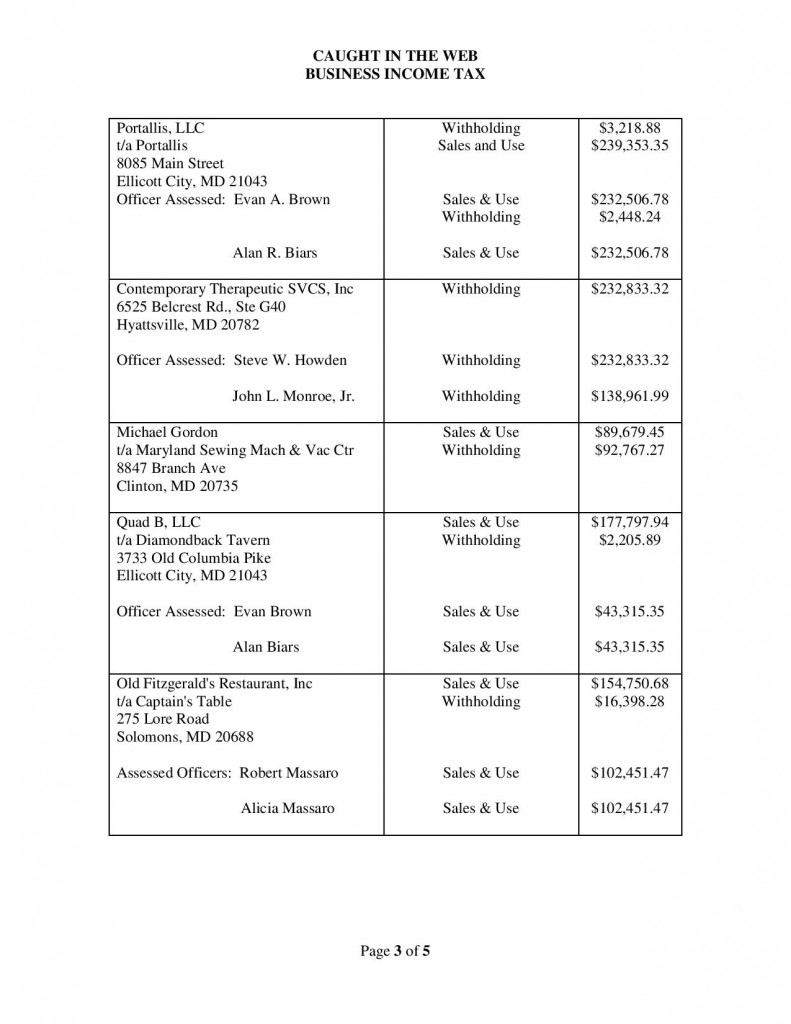

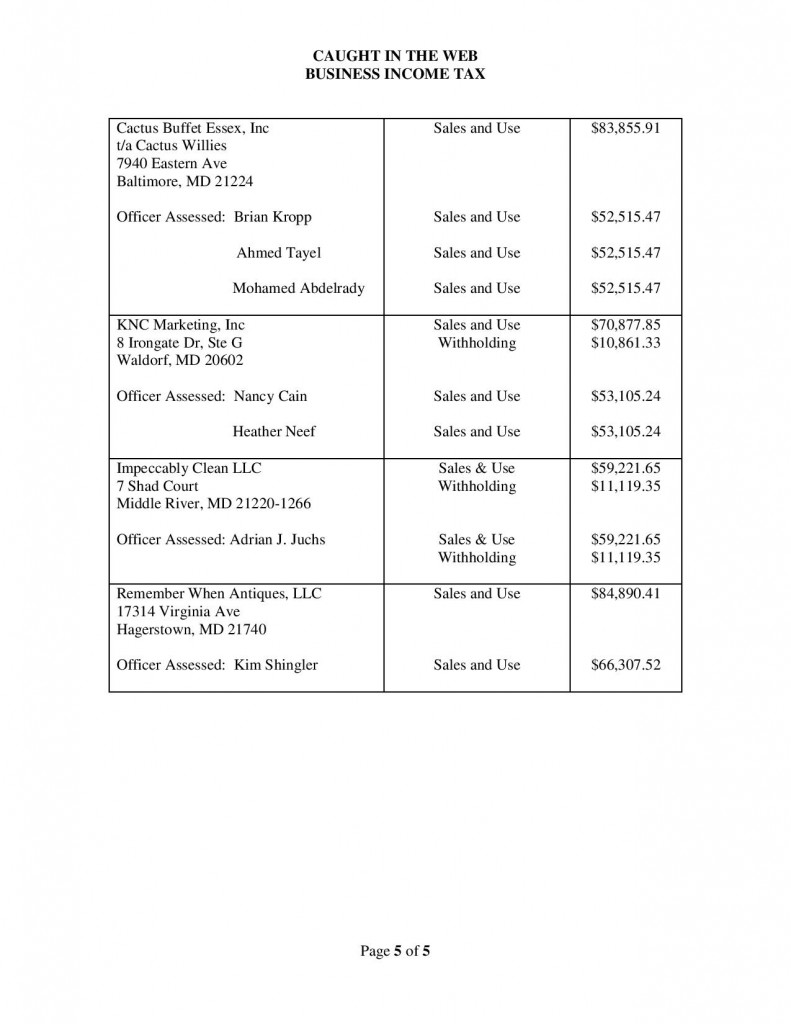

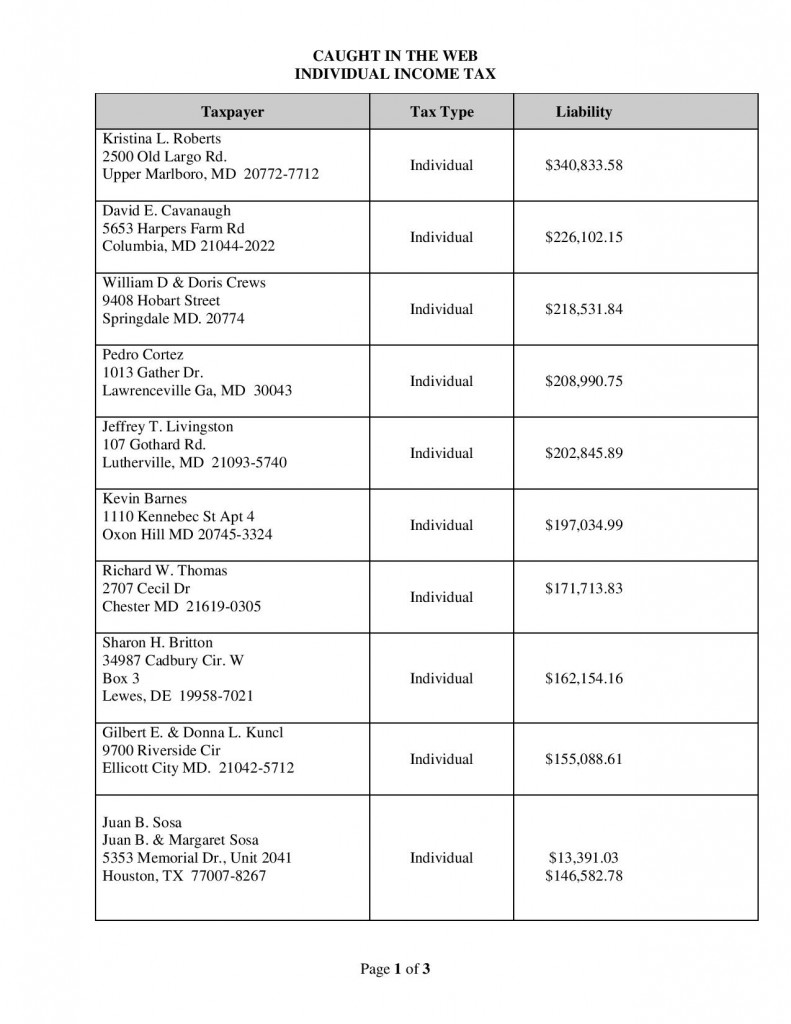

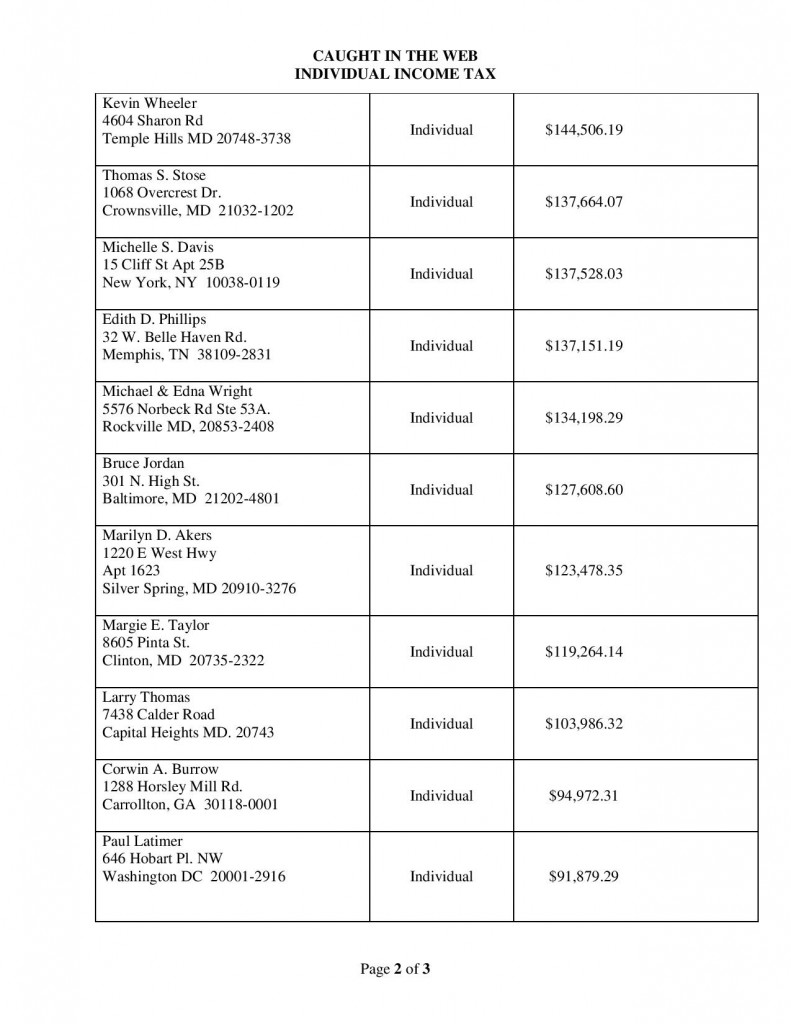

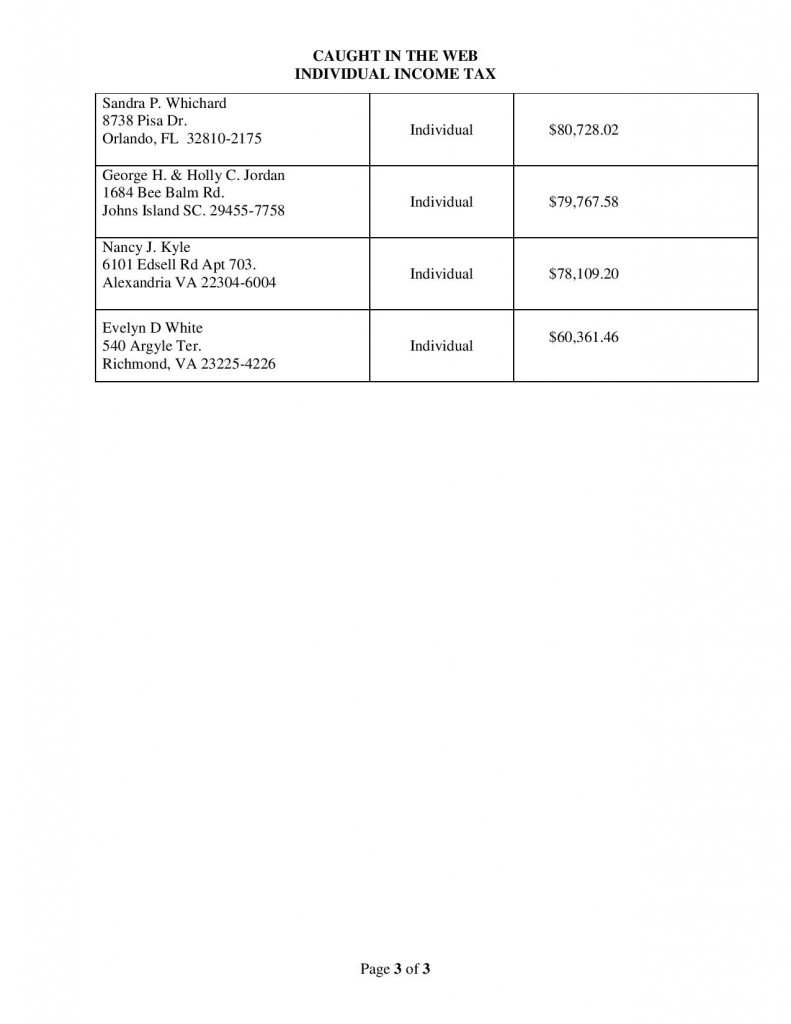

Comptroller Peter Franchot announced the names of the top 25 businesses and individuals collectively owing nearly $15 million in unpaid taxes, penalties and interest to the state of Maryland. Known as theCaught in the Web program, the Comptroller’s Office routinely publishes the list of the top 50 scofflaws on the agency’s website, as a public attempt to get people to pay.

“The Caught in the Web program highlights the small number of Marylanders who have chosen to take advantage of the benefits of this great state, but who make a conscious effort to avoid paying taxes,” said Comptroller Franchot.

“These are not people simply down on their luck and unable to pay, but individuals and business owners who knowingly thumb their noses at the vast majority of Maryland taxpayers who fulfill their legal obligations to the state,” he added.

Created to send a message to those who have ignored attempts by the state to collect overdue taxes, the program names tax delinquents owing the largest sum in back taxes on the agency’s website for six months, until payment has been received or a payment plan has been initiated.

Since the program’s inception in 2000, the agency has collected more than $27 million from delinquent taxpayers whose names appeared on one of the agency’s lists. The most recent group includes liabilities of nearly $3.69 million in back taxes, penalties and interest from 25 individuals and more than $11 million from 25 businesses.

When an individual fails to pay their taxes, the Comptroller’s Office initially sends a letter listing any unpaid charges incurred for taxes, interest and penalties. Should the taxpayer fail to pay, enter into a payment plan, or provide a qualifying reason for having not yet paid, the Comptroller’s Office may then:

- File a lien,

- Garnish wages,

- Prevent renewal of state business license,

- Prevent renewal of professional and occupational licenses,

- Attach assets (including bank accounts),

- Intercept state and federal tax refunds,

- File an estimated assessment for taxes due in unreported periods,

- Issue a summons to appear at a hearing to revoke a sales tax license or initiate other

legal processes; or - Suspend state payments if the taxpayer does business with the state

Taxpayers, who fail to contact the agency to satisfy their tax liability or enter into an agreement to do so, are eligible to be included in the Caught in the Web program. These individuals and businesses, which have already had liens filed against them, are notified prior to the list’s posting that they will be included.