Investor’s Alert: Florida’s Top Emerging Housing Markets to Watch

Florida’s real estate landscape hollers at investors with sheer possibilities. Teeming uptown and restful seaside cities have produced one of the best-emerging housing markets in the Sunshine State. From veteran investors to tryouts, insights are the key to staying ahead of the curve. So, let’s go through this write-up to learn more about it.

Emerging Housing Markets: Investors Hotspots in Florida

After thoughtful consideration, I’ve shortlisted the most promising housing markets in Florida that every investor should keep an eye on.

Orlando

Orlando has one of the largest populations in the state of Florida. Retaining the current trajectory, it will have 3.2 million residents by 2030. You probably get it where I’m going with this. Yes, this will drive a humongous demand for housing.

Up until 2023, Orlando houses saw a 10% year-over-year growth in value. It was $370,000. Still a lot lower compared to Miami and Naples.

With the presence of global players such as Walt Disney World and Universal Studios, new residents always flock to this city. Just in 2023, Orlando had over 75 million tourists. And it affects the rental market positively at the same time.

Such a magnitude of place will see 6-8% growth in home price and 5-7% in rental rates according to different market analysts.

Fort Myers

In the Southwest part of Florida, the housing market might see the highest-ever growth in the housing market. Investors who are aware won’t let it slide under their radar, for sure.

Data from the previous years are ridiculously impressive. Population, job market, and economy all are on the rise. And so does the housing market.

To give you a demonstration, here’s a few data on Fort Myers in the year 2023:

- Population (2010-2020): +22% ↑

- Unemployment rate (2023): 2.7% (Lower than average)

- Home Value (2023): +16.5% ↑ YoY

- Average house price (2024): $365,000 (Lower than major cities)

- Rental yield (2023): +8% ↑

Now, from the data above, it’s clear that Fort Myers has a potential housing market in general. The house price is lower than most of the cities in Florida. So there’s a significant migration going on. This will require more expansion in the region.

Not to mention, analysts are predicting a sustained growth in population and housing demand.

Tampa

Despite Tampa’s relatively slow population growth, it has 3.2 million citizens. The good thing is that the population growth is steady. Plus, the living cost is 5% lower than the national average.

In addition, Tampa outpaces the national GDP average with 4.5% in 2023. This had a direct effect on the housing market where the average home price went up by 11.2% year over year.

The development works in Tampa open a new horizon for real estate investors. The $3 billion Water Street Tempa project promises to remodel the downtown area with new residential, commercial, and recreational spaces. That’s a win for investors.

Naples

Debatably Naples tops the chart among the potential housing markets in Florida. The data from the U.S. Census Bureau shows that the population increased by 16% from 2010 to 2020. And this trend is not scaling down. By the year 2030, this city is about to see its highest ever 6 million residents.

With that increased demand, the housing market is growing strong in Naples. As of early 2024, the average home value is around $650,000. And that is 8% higher than last year. It’s much the same compared to the data from 2022 to 2023.

More often than not, Naples is a prominent place due to its luxury homes. And guess what? As claimed by The Naples Area Board of Realtors (NABOR), they received a 30% growth in sales in 2023.

Not only that, the average gross rental yield is 6%, and a potent property tax of 0.73%. For homeowners that sounds like a high return on investment.

Sarasota

With residents of over 4,75,000, Sarasota County sees enticing development in the housing market. Although in 2023, home prices went down by 6.4%, it saw a massive 15.6% increase in 2022. However, single-family homes and condo prices grew 4.5% and 6.5% respectively.

Even though the average home price is higher in 2024 which is around $400,000, it’s still quite affordable than Miami. This pulls both first-time homebuyers and retirees.

Moreover, due to the strong job market, affordable home prices, and stable economy, people often move to Sarasota. This creates demands in the rental market as well.

The development of the I-75 corridor and Sarasota-Bradenton International Airport takes things even further for businesses and residents. These make Sarasota more attractive as a housing market than ever.

Cape Coral

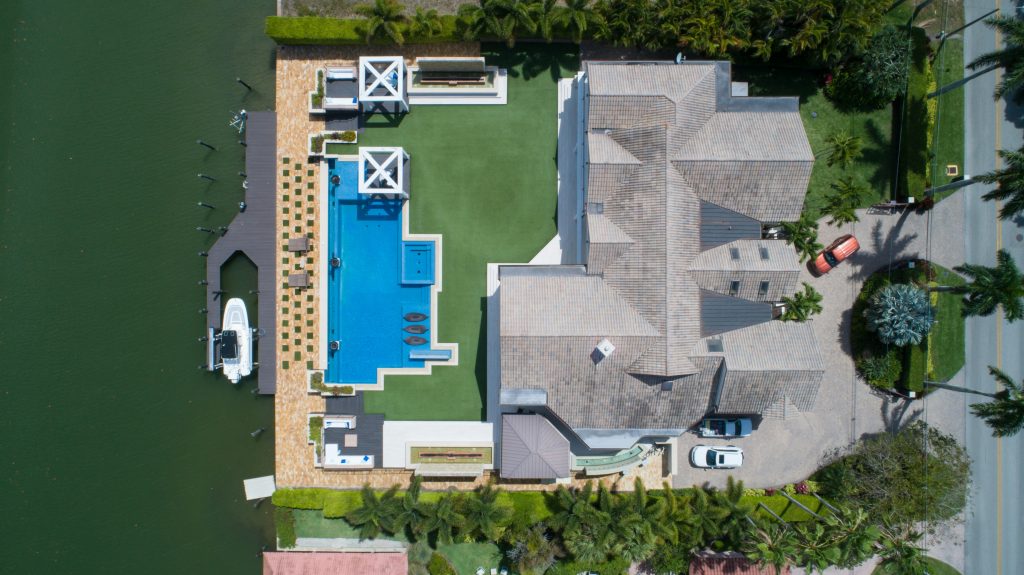

Having 400 miles of canal running through, and a panoramic waterfront location turn Cape Coral into a tourist hive and a lovely housing estate. Such a demographic dearly pulls young professionals and families.

As per the U.S. Census Bureau, the population shot up 25% within the last decade. It is expected to reach 250,000 by 2030. So, there’s a vacuum in the housing market right now and for the coming years.

And it shows through statistical data. According to Zillow, in 2023 the average home price in Cape Coral was approximately $370,000. That translates to a 15% growth over the past year.

Besides, tourism created a persistent rental market. Rental yield average hovers between 6% to 8%. If I put it another way, it means great returns for rental property investors as well.

Boynton Beach

For investors as well as homebuyers Boynton Beach is an exciting place in Florida. For a coastal lifestyle, this city has Palm Isles-like refreshing places.

Featuring over 80,000 residents and newcomers, this Palm Beach County undergoing a rising demand for accommodation.

Such a need for housing caused property values to jack up. For example, from 2017 to 2024 home prices have gone from $230,000 to $400,000. The rental market also moves in the same direction.

What is more interesting is that building permits issued for residential properties rose 12% from 2022 to 2023. It’s a green light for any visionary investors.

Evolution of Florida’s Housing Markets Over the Years

Historically Florida experienced a boost in real estate due to its delightful climate. Moving forward, this place is marketed heavily as a tropical haven. Despite the brief bumps such as natural disasters, great depression in the way it continued to attract residents and investors.

From the 1950s to 1960s, it saw suburban expansions in different cities such as Miami, Tampa, and Orlando.

Just a decade after that, Florida’s housing market saw a diversity. People from different walks of life such as retired personnel formed communities in Gulf Coast and Central Florida.

Fast forward to the 21st century, the housing market has grown faster than ever. Thanks to easy credit and academic investments. In 2007-2008, however, the housing market crashed and property values declined.

Luckily by the mid-2010s, the housing market stabilized in Florida. And during Covid-19 it became one of the most desired places to relocate due to the “Remote Work” policy.

The future however seems to have a steady-going due to demographic trends and economic conditions.

Final Words

Florida’s housing market is diverse just like its residents. These offer vibrant urban places, lavish homes, and serene Pacific lifestyles. Smart investment in these markets means a brilliant return for anyone interested. Stable population growth, strong economics, and overall high demand for housing show remarkable prospects.