COVID-19 Balancing Act: Money or Your Life?

BALTIMORE – There’s an ancient Jack Benny routine that allegedly drew the longest laugh in all of radio history. But it’s got a modern connotation that gives it new meaning.

Benny’s comic persona was built on his tightness with a buck. In the old routine, a stick-up man demands, “Your money or your life.” The skinflint Benny doesn’t move a muscle.

“I said, ‘Your money or your life,’” the hold-up man repeats. Finally, Benny answers.

“I’m thinking,” he says. “I’m thinking it over.”

In the modern context, we’re all thinking. As The New York Times headline phrased it over the weekend, “Your Life or Your Livelihood: Americans Wrestle with Impossible Choice.”

Around the U.S., we’ve got all kinds of states re-opening for business, to one extent or another. It’s not because we’re past this coronavirus catastrophe, that’s for sure. It’s because the economy’s down, more people than ever are out of work, millions can’t pay their rent or buy food – and those willing to roll the dice with their lives are now leaving their homes, heading back to work, and hoping that customers will follow.

Also, hoping they don’t get sick and die while they’re doing this.

In Maryland, Gov. Larry Hogan’s been cautious all through this pandemic. He knows people want their old lives back. He knows the anxiety felt by so many steady, hard-working people who have always thought of themselves as middle class but suddenly find themselves living closer to economic disaster than they ever imagined.

Many showed up in Annapolis about a week ago, outside the State House, to tell Hogan that they want this state back in business before their bank accounts are drained altogether.

But Hogan also knows, in the current crisis, that science matters more than economics, and more than politics, too. You send people back to mingling with each other prematurely, and you may be risking their lives and setting loose a second wave of the killing virus.

We have here a delicate balancing act.

Last Friday, May 1, millions of Americans faced an old challenge under new conditions. Their rents and mortgage payments were due.

Meanwhile, about 3.5 million Americans filed first-time claims for unemployment benefits in the week ending April 25. This brings the total number of first-time claims to 30.3 million Americans over the last six weeks. That’s 18.6 percent of the U.S. labor force, as businesses have laid off and furloughed workers during stay-at-home orders.

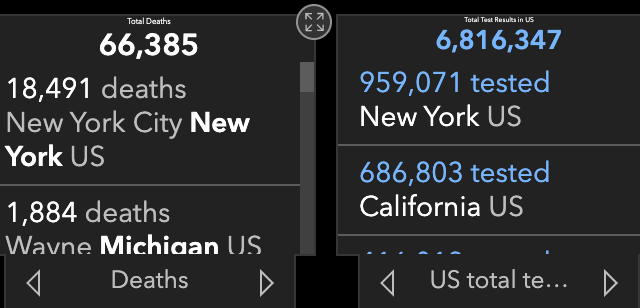

So nobody needs an explanation about the hunger to re-open the country for business – except for that other part of the balancing act, in which more than 63,000 Americans have already died from the coronavirus, and more than a million have contracted the disease.

Your money or your life, indeed.

As that New York Times story noted, “Americans whose governors said it was time to reopen wrestled with what to do, weighing what felt like an impossible choice. If they go back to work, will they get sick and infect their families? If they refuse, will they lose their jobs?”

So the immediate conflict, between life and livelihood, is clear. But isn’t this the time for Americans to take the longer view?

Over the past 40 years, millions have told themselves a fiction. They’ve called themselves middle class, or working class. They’ve told themselves the American system of cold capitalism and raw political bullying has worked out for them, that their families are secure, that they’re doing well and their children will do even better.

And the fiction they told themselves came completely apart – and did it in record time, a week or two before they realized what a thin and ragged safety net existed for them. It’s a safety net so thin, and so full of holes, that many are now willing to risk their very lives by going back to work too soon.

But there’s something else millions should be doing: asking how so many of us got into such vulnerable financial shape, and what we have to do to get out of it, without risking our lives in the process.

Michael Olesker, columnist for the News American, Baltimore Sun, and Baltimore Examiner has spent a quarter of a century writing about the city he loves.He is the author of several books, including Michael Olesker’s Baltimore: If You Live Here, You’re Home, Journeys to the Heart of Baltimore, and The Colts’ Baltimore: A City and Its Love Affair in the 1950s, all published by Johns Hopkins Press.