How the Bitcoin Blockchain has changed?

Bitcoin has certainly stirred up some controversy over the last few years. There are those who believe that the cryptocurrency embodies the basic principles that the internet was originally founded on – transparency, no central controlling authority, and anonymity.

Then there are those that see the cryptocurrency as an unregulated nightmare. As something that made it much easier to conduct illicit transactions under the table. And, while it was not the founder’s intention, initially it was a useful way to fund transactions on the dark web.

The truth today lies somewhere in between the two extremes. Law enforcement officials closed down the biggest illicit marketplace on the dark web and are now able to check the Bitcoin blockchain for transaction patterns that might point to money laundering or other illegal activities.

The transactions on the Bitcoin blockchain are anonymous but can be traced by authorities. If they identify transactions that appear suspicious, they are able to investigate who the owners of the addresses are.

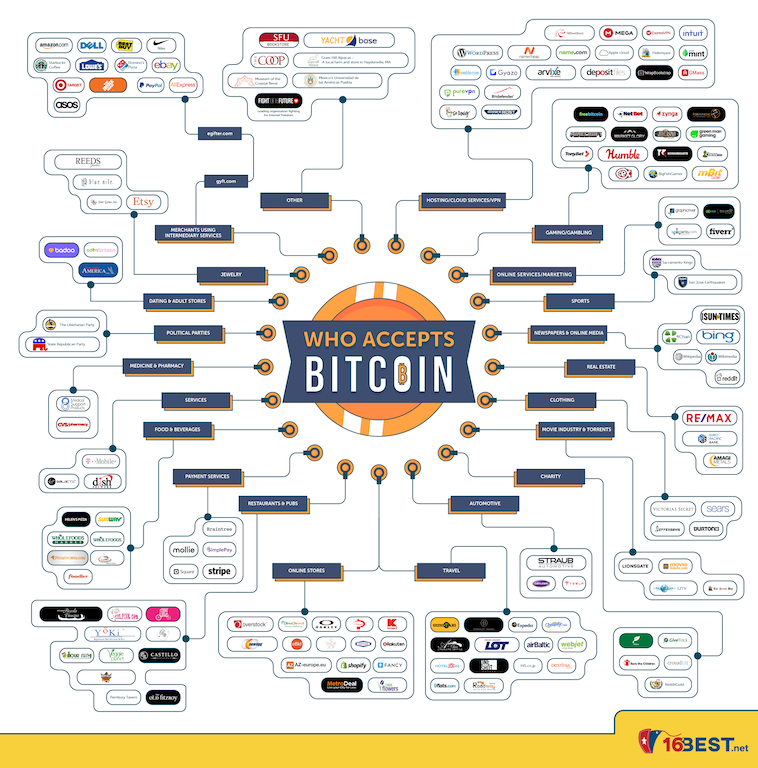

This sounds a lot more serious than it is though. Say, for example, you use your Bitcoin to take purchase a video game or partake in some innocent gambling, you are not going to raise any red flags. In fact, these days you can do a lot of things with Bitcoin – like booking travel destinations on Expedia, paying for a cab fare, and (on some rare occasions) even ordering a pizza, so it isn’t nearly as shady as it used to be.

However, the money launderer that keeps making high numbers of transactions, or high-value transactions is more likely to get caught out.

Regulatory bodies have also started introducing stricter regulations when it comes to Bitcoin and other cryptocurrencies as well.

The SEC, for example, has been cracking down on Initial Coin Offerings, stating that the Howey Test must be applied to see whether they are classified as securities or not. If the Howey Test is applied, many cryptocurrency investment opportunities may be classed as securities and thus be liable for stricter regulations.

Tax agencies across the world have also been looking into taxing the proceeds of trading and investments in cryptocurrencies.

Legally speaking, many countries have also been cracking down on the trade and use of cryptocurrencies. China, for example, recently banned the trading of Bitcoin and other cryptocurrencies within the country and forced locally based exchanges to close.

To take things one step further, they also implemented measures to ensure that results relating to cryptocurrencies where scrubbed from any search engine results within the country. The country sited that the measures were put in place to protect the Asian economy.

Other countries, such as Bangladesh and Saudi Arabia, have made Bitcoin completely illegal.

So, yes, regulatory bodies are taking a greater interest in the cryptocurrency and are imposing stricter regulations on it. There is also every indication that more stringent regulations could be on the cards further down the line.

So, the days of Bitcoin being completely unregulated are certainly over. There are still benefits in terms of the lack of a central controlling body, anonymity, and transparency, though.

While the regulations do need to be considered, there is no one controlling body that has complete control over Bitcoin. So, no one government or regulatory agency could completely shut the blockchain down.

Even if users are blocked in one country, the ledger is still distributed amongst all the other computers within the network. So, even if 90% of the network went dark, the blockchain would still be able to function – it just might take longer for transactions to be verified.

Transactions are conducted anonymously so you do not have to give out your personal details to sellers. And, while authorities may be able to track down the owner of the account, it is difficult for a regular citizen to do so.

Finally, all transactions that have been added to the Bitcoin blockchain are open for public view. You won’t be able to see exactly who made the transactions, but you will be able to have a look back over all the transactions within the chain.

So, while Bitcoin is not exactly as free of regulation as it once was, it still has other advantages for its users. This still makes it a valuable player in the market.

Karthik Reddy, Community Manager at www.16best.net, is the author of India’s Number 1 travel blog. Boasting an MBA in computer science, he once decided to get away from the office desk life and take a breathtaking journey around the world. He is eager to use the power of the global network to inspire others. A passionate traveler and photography enthusiast, he aspires to share his experiences and help people see the world through his lens.