All That You Need to Know About First Savings Credit Card

When you get into something new, you expect the finest outcomes from it, don’t you? No matter you are trying a new recipe, going on a cruise vacation, applying or a job or picking a dress for a festival, you always want the best. After all, the best results will translate to a transpiring and memorable moment in life. The same rule applies while applying for a credit card as well. If you are applying for a credit card for the first time then going with first savings bank credit card will be the right choice.

Basic Facts about First Savings Credit Card

It is a reliable credit card issued by the First Savings Bank. It will offer you access for using the card for making payments at restaurants/hotels and online shopping. A key reason behind its growing popularity is that this credit card does not have an annual charge. People can apply for this card only if they get a special invitation via a mail. The invitation is for people having lower stellar credit. The invitation is sent to people having a horrible/poor credit history that are desperate in repairing the credit situation but has limited choices.

How to Apply for First Savings Credit Card?

Being an exclusive invitation-only affair, applying for this credit card is not possible before getting an invitation via email. You need to use both the Reservation Number and the Access Code that you receive through the mail for making the application. For proof of identity, you need to send them a copy of both your utility bill and driver’s license. To be eligible for this credit card, you need to be a minimum of 18 years. After this, you have to wait to get the card.

Tips to Log In

After the acceptance of the application, you will turn into a cardholder and can log in easily for managing the account of the first savings credit card. Being a registered user, it will provide you with the flexibility of making online purchases, viewing account information as well as automatic scheduling payments. Everything will get done via the cardmember portal. Just enter the username and password to have access to the account.

Rates and Fees

Take a look at the prices and fees associated with the first savings credit card,

- No annual fee

- No yearly introductory rate of percentage

- APR or annual percentage rate is not applicable

- No cash advance annual percentage rate

- No cash advances fee

Ways to Activate the Card

Now the question is how you will activate the first savings credit card? Here, take a close look,

- Once you receive this card through the mail, you need to activate it to access it online. You can also activate it via the online portal or calling at the given activation number.

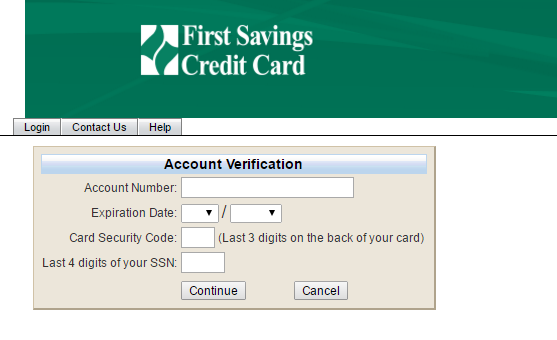

- Visit the card’s activation screen.

- On the pop-up page, you will see the section Register New User where you need to enter some details- account number, the date of expiry, the security code of the cardholder, the social security number’s last 4 digits and then click OK. The card will get activated in 1-2 days.

First Saving Credit Card and its Alluring Features

Take a look at some of the alluring features that have made the first savings credit card so popular,

- You can use the card for dining at restaurants and going shopping

- It will help you in controlling your spending.

- Being optional it will make monthly payments easier.

- Its security design will make the transaction safe owing to its improved security code that is attached which will stop unauthorized purchases.

- There are no hidden fees on penalty APR

- Provides secure online access

- Fraud coverage in case of stolen or lost card

- No charges on the annual fee

The significance of Reading Reviews

With tremendous competition around, reputation and credibility play a vital role because one negative review can ruin everything. Credit card reviews of late have turned into a game changer for holding the reputation as well as engage the customers with the best quality card and benefits. Feedback of the customers plays a pivotal role to know how the card is performing and what makes it have the upper hand over others. If you are still not convinced about going for a first savings credit card then reading a good first savings bank credit card review can help a great deal. Some banks exaggerate about their credit cards and its abilities by blowing it out of proportion. So, until one reads the reviews from people who are using it, they will not be capable of determining their real strength. When you read reviews about the credit card before investing in it, you can enjoy that great satisfaction and peace of mind as you will know what exactly to expect. If you are not aware, there will be some doubt on the investment made. Reviews will reassure that you made the right choice.

If in case you are facing some significant problems with your credit, the first savings bank credit card will be the card that you need to consider. It is the perfect choice for people on the lookout for an opportunity for building their credit. As opposed to other credit cards that are available this card comes with different options. Every choice available has unique features and conditions designed for catering to the requirements of every individual. You can make the first savings bank credit card payment through 6 ways- online, through phone, MoneyGram, Western Union, debit card and mail.

This credit card is especially for the young generation that is planning to build a credit history. Invest in this credit card right away to take pleasure of all the perks of financing. It will open seamless opportunities for the user in the future. Reap the perks of its acceptance the world over. If the card, unfortunately, gets lost or is stolen; this card comes with fraud insurance which will help in preventing you from paying what you did not spend.

Can you use this card other than a restaurant or hotel

This article is wrong. There’s nothing wrong with this card if you read the terms and conditions before you agree to opening it. Specifically the author says “no hidden fees on penalty APR” and “No annual fee” and “APR or annual percentage rate is not applicable” None of this is true and doesn’t make sense anyway.. There is a $75 annual fee, and you most definitely will pay fees and interest if you miss your payment due date so the “no fees on penalty APR” is fluff language. In fact the regular APR is the penalty rate for most prime credit cards. I think the one thing I would give this card credit for is that it has no mention of a grace period in the terms of service, but if you pay your balance in full by the due date, you won’t be charged interest.