The Chicken, the Price of Eggs and the Chairman of the Fed: Using Monetary Policy to Curb Inflation

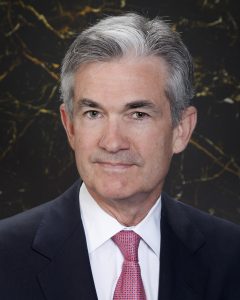

This is a story about two noble creatures. One is a chicken, the kind that lays eggs. The other is Jerome Powell. Mr. Powell is, of course, the Chairman of our Federal Reserve System who is tasked, among other things, with keeping inflation under control. Given the limited set of tools at his disposal, this is a daunting responsibility.

The chicken, although much more common and less powerful, is nonetheless impressive for her extraordinary productivity – to which I’ve added the burden of being symbolic of all things inflating. Not only are the prices of her eggs rising, this chicken also represents the prices of other foods, gasoline, rent, name it, the inflation of which is troublesome. Without question, inflation is serious business and could cost the Democrats control over the House and Senate.

Mr. Powell is a very intelligent, highly competent individual. Unfortunately, he’s the wrong person for the job.

“What job is that?”

Good question because it goes to the heart of the problem. To be precise, what we are asking Mr. Powell to do is reduce inflation in markets for essential consumer goods and, in the process, put consumer prices back where they were a couple of years ago. Oh, and he has to get that done before the mid-term elections just six months from now.

Slowing the rate of inflation – when the Fed’s only tool is control over rates of interest – is a difficult and time-consuming trick. Raising interest rates too much and/or too fast could put the economy in a recession that might slow inflation, but not in a good way.

Gasoline prices haven’t gone up, nor have the prices of eggs and other groceries risen because interest rates were too low. Raising rates isn’t going to somehow reverse the process.

The prices of consumer products have gone up, some more so than others, because of issues in their respective submarkets. In a world of microeconomics, national, indiscriminate, macroeconomic monetary policy is a gross instrument with limited power. It’s the dumb bomb when what we need are precisely targeted policies capable of dealing delicately, but nonetheless effectively with highly variable, complex market relationships with minimum side effects.

Raising interest rates to control prices of consumer goods is like punching someone in the stomach to distract him or her from a headache and then, if the headache eventually goes away, claiming to have been the cure. It’s a treatment that misses the point and could be worse for the patient than the problem it was supposed to resolve.

Can you stop inflation and reduce the prices of consumer goods by raising interest rates? Not really. All you can do is slow down the economy to such an extent that you reduce demand for consumer goods. Raising interest is, in other words, a demand-side tool you’re using to cure a supply-side problem. The price of gas isn’t rising because demand is too strong. It’s rising because, under special circumstances, there isn’t enough oil being processed. It’s not a trivial distinction.

So the plan is to slow the entire economy down – largely at the expense of middle- and lower-income families – until household incomes fall enough to reduce demand for specific consumer goods and the rate of inflation and prices drop to acceptable levels? It’s ridiculously circuitous and gross.

In fact, raising interest rates, uniformly across the entire economy, might actually be counterproductive to the extent that higher rates discourage investments that would, eventually, increase the supply of goods available to consumers.

The definition of inflation used to be “too much money chasing too few goods.” It’s a simple concept, but unrealistic. Inflation is not just some classical economic problem undergraduates learn in freshman courses. It has political, social, psychological and geographic dimensions – and more to do with market imperfections than the rules of a non-existent, textbook-perfect free market economy. Inflation in the cost of eggs isn’t caused by nor can it be cured and reversed by precisely the same monetary policy the Fed uses to reduce inflation in the price of gasoline, apartments and prescription drugs.

We rely upon the Fed when it comes to inflation, not because it’s good at fixing it. It’s because our government is lazy and uninspired. It’s because our government – Democrats and Republicans alike – lacks the creativity and initiative to devise and implement policies that respect the economy – and might one day head off inflation, even in crisis situations, before it gets out of control.

Now, be honest, just between us chickens, does anybody reading this really think that the Fed’s raising interest rates is the way to get inflation in the price of eggs under control?

Les Cohen is a long-term Marylander, having grown up in Annapolis. Professionally, he writes and edits materials for business and political clients from his base of operations in Columbia, Maryland. He has a Ph.D. in Urban and Regional Economics. Leave a comment or feel free to send him an email to [email protected].