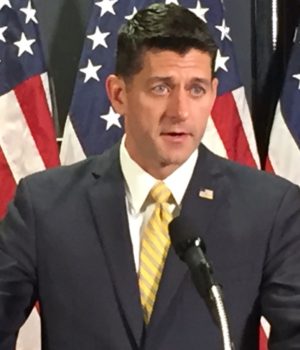

Ryan on tax reform: ‘This is a now or never moment’

WASHINGTON – House Speaker Paul Ryan (R-Wis.) on Wednesday called on Congress to begin consideration of the tax reform package Republican lawmakers crafted in conjunction with the Trump administration.

“This is a now or never moment,” Ryan said at a news conference accompanied by about a dozen House and Senate GOP lawmakers.

“The choice before us is really clear: We can succumb to the talking heads on TV and the special interests who want to maintain the status quo, or we can work together to seize this moment and do what the American people sent us here to do,” he added.

President Trump is expected to formally unveil the plan during a speech in Indiana later in the afternoon.

If fully implemented, the administration’s tax reform package would represent the most comprehensive overhaul of the Internal Revenue Code since the Reagan administration.

The maximum corporate tax rate would be reduced from 35 percent to 20 percent. The maximum personal income tax rate would be reduced from 39.6 to 35 percent. The existing seven personal income tax brackets would be consolidated into three.

Pass-through taxation – which applies to most businesses that are sole proprietorships, partnerships and limited liability companies – would be reduced from 35 to 25 percent and the estate tax would gradually be eliminated.

Republicans have included budget reconciliation instructions in the FY 2018 budget resolution. The budget resolution is the vehicle being used to bring about tax reform.

Reconciliation lowers the threshold for breaking a filibuster and would allow for the proposal to pass the Senate with a simple majority as opposed to 60 votes.

Senate Minority Leader Chuck Schumer (D-N.Y.), in a Wednesday morning floor speech, said the Trump administration’s tax reform proposal would “result in a massive windfall for the wealthiest Americans and provide almost no relief to middle-class taxpayers who need it the most.”

Schumer said the proposal would add $5-7 trillion to the deficit and take money away from crucial safety-net programs.

This article is republished with permission from Talk Media News

Bryan is the managing editor of Baltimore Post-Examiner.

He is an award-winning political journalist who has extensive experience covering Congress and Maryland state government. His work includes coverage of the first election of President Donald Trump, the confirmation hearings of Supreme Court Justice Brett Kavanaugh and attorneys general William Barr and Jeff Sessions, the Maryland General Assembly, Gov. Larry Hogan, and the COVID-19 pandemic.

Bryan has broken stories involving athletic and sexual assault scandals with the Baltimore Post-Examiner.

His original UMBC investigation gained international attention, was featured in People Magazine and he was interviewed by ABC’s “Good Morning America” and local radio stations. Bryan broke subsequent stories documenting UMBC’s omission of a sexual assault on their daily crime log and a federal investigation related to the university’s handling of an alleged sexual assault.