A Living Nightmare: Dealing with Loan Servicer MOHELA

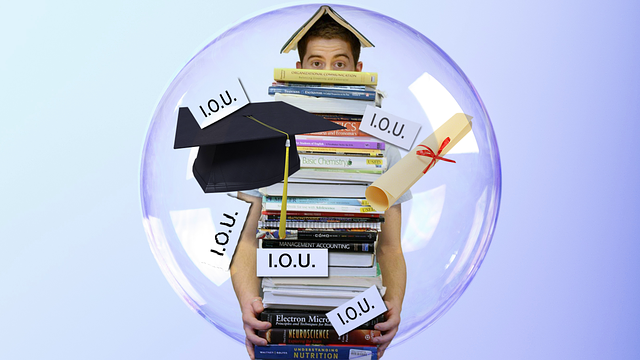

Regardless of how any of us feel about the student debt nightmare in this country, when our president does make a decision, then the process that follows should work.

As a former “woke” academic, I have a lot of education. I understand I have to pay for it, but that process should be reasonable and not abusive to the customer. But like many student loan borrowers, I feel as if the CIA got a hold of me, an enemy combatant, and applied my body to a kinder, gentler Pakistani chair.

I offer, here, a case study of just how abusive loan servicers can be. I owe money, but I was also promised previously by my now-dead loan servicer that my loans would be forgiven in ten years.

That was a lie.

When MOHELA took over, I could see that things would go from very bad to very much worse. However, MOHELA is not totally to blame. Higher education has become a predatory system. It often provides false promises that the long-gone American Dream is still attainable … if you take out enough loan money.

A Brief Higher Education Overview

President Biden has come as my savior. Unlike many who oversimplify student loan debt and blame people for trying to improve their lives, getting loans is a very complex process. For example, financial aid offices have to certify giving each student money. They seem to have no problem certifying many people who have debt.

Colleges and universities moved from educating the few—yes, the privileged—to the masses (all of us flyover folks who are not important). Slowly, business managers replaced academics as school budgets got squeezed. Students became cash cows and faculty were seen as a waste of money. What matters is to get students, exploit them with manipulated data, and give them what they all want: a piece of paper that says they can now “get a job.”

Schools became predatory, from the community college to the Ivy League. The goal is to get students, make money on them, lower academic standards by pretending to heighten them and create useless programs that keep college doors open. Who does an actual thesis or dissertation anymore? Many companies and businesses are wising up to this. They realize they can train people. We don’t have to really go to school. I should know, I was a college professor for 20 years.

How Biden Fails to Fix What He Started

Typical of most politicians and leaders of large organizations, the Biden Administration made grandiose claims that they wanted to fix a justifiably broken and exploitative system. Yet, President Biden cannot just set a new policy and expect that everyone underneath is going to deliver. Sending millions of student loan borrowers flooding new loan servicers like MOHELA is irresponsible. Such is causing undo harm to the employees at MOHELA as well as borrowers like me. Biden can fix it. He won’t.

It is true that student loan borrowers will not be reported to credit agencies until later this year; however, that does not stop Student Aid and MOHELA from sending out weekly default letters and phone calls from MOHELA looking to collect money that the customer does not actually owe yet! They have people for that but not enough people to process new SAVE applications. Hmm, something is amiss.

The way MOHELA is set up does beg the question if the system is there to abuse borrowers just like the previous student loan forgiveness program was. The goal may be to force money out of us. Biden, his administration, and the bigwigs at MOHELA know very well what is happening. Just because we owe a debt does not mean borrowers should be mistreated. My only real form of communication is now filing regular complaints with the Customer Financial Protection Bureau. The CFPB has become MOHELA’s customer service. Here is why.

It is no exaggeration that if you plan to contact MOHELA, you should take a day off from work. The only form of communication is calling them. This is 2024, right? They claim they have email. They do not. It’s like a phone call. The customer is taken from question to question only to end up where they started, at the beginning. When I attempt to call, the automated menus send me in circles, when what I need is a customer service agent, not AI which is anything but intelligent. I had to go through five menus. It is like the customer service representatives are Navy Seals in a covert operation: Operation Screw the Customer. You cannot get a hold of them.

Here we are being told we are in default, though we are not, but we are being treated like we are with no way to contact a person. When I finally got to customer service, I was never able to get through. I had to go to work. If I don’t go to work, I don’t get paid. I have one of those unimportant jobs, driving kids on dangerous highways.

My Situation in a Crazy Nut Shell

When Biden implemented the SAVE Program, which allows borrowers to pay a manageable amount based on income, and if we do pay, the rest will get discharged in 20 years, MOHELA was supposed to put me automatically in the SAVE program. They did not. I was told I had to pay at first over $3600 per month. That did change to $1860 per month.

I cannot afford that, but more importantly, I am not supposed to afford that given what payment plans are offered to me. I know this. That is why I went to school and created the debt. But no matter what I did, I could not get a hold of MOHELA. So, I filed a complaint with the CFPB in the fall of last year.

At the end of November, MOHELA responded and said I would be put on the SAVE Program, and that it was their mistake. Though my $1,860 payment dropped to $1.76 per month (hey, I drive school buses), they never took off the $1,860 I was told I owed. There is common practice to give a forbearance on past money owed when a customer cannot pay and puts in an application to that effect. I did this before my loan due date. They approved the loan, but still sent bills for $1,860.

I ended up sending a fax. Someone there must have made a critical mistake in sending something in writing because I got actual snail mail, a response. The letter informed me that MOHELA made an error, that I do not owe $1,860, and that they failed to apply my forbearance. They noted that the issue would be fixed in “three to four business days.”

That was dated on November 30, 2023. It is February 11, 2024; I continue to get collection calls and letters telling me I am 80-plus days late. In fact, MOHELA called me on my birthday. They must have known and told me I was 72 days late and owed $1,860. I told the representative the situation, and she tried to contact her supervisor for 30 minutes. She acknowledged the mistake but told me after a half-hour hold that the supervisor is “working on it.” That was January 23rd. Apparently, her supervisor is still working on it because nothing has changed. I received two more collection calls from MOHELA in the past week.

Psychological Warfare?

I filed another complaint with the CFPB since MOHELA is 80 days late in updating my SAVE application and starting my $1.76 payments. I have not gotten a single bill for $1.76, though I paid it in December. That payment plan expires before it got started in late February. I can only imagine what nightmare is next for me. MOHELA has plenty of people to go out and try to get people to pay money that is not due on their accounts, but they don’t have enough people to process the applications or to provide reasonable customer service through chat, text, phone, and email. If we get someone on the phone, we are often lied to just to get us off the line.

Gross Negligence

Both MOHELA and the Biden Administration have shown gross negligence in rolling out these loan forgiveness programs. I have spent my life taking lower pay and doing jobs for the greater good. Though I am responsible for money I agreed to pay, such does not mean I should be abused repeatedly, lied to, and given false promises. Many wealthy CEOs and companies write off immense debt and even get bailed out with taxpayer money. Many go bankrupt, while still making millions in compensation. We all pay for that or it gets charged to our national debt. Am I wrong to want my debt canceled out? The only job I really want is to drive school buses, but I cannot afford to work as a school bus driver though it’s full-time work.

I may be in the top five in student loan debt in the nation, but millions of people are in my situation. Like many human problems, this mess is a combination of our own misjudgments and others. It is a human system that is loaded with human greed and flaws. But we often forget who has leverage, and that would be those in power. They take advantage of and exploit student loan borrowers for personal gain. I cannot help but feel that this negligence is deliberate, and carefully planned, or the people in charge are so incompetent that they may not even be fit to hold down a job. Either way, this situation is causing undue stress on millions of people, even costing them from finishing their degrees. How does that help them?

Such debt complicates our lives. It is not enough to “cancel” or reduce debt payments when the system is designed to drive people to despair. Someone is responsible, and that is always the people at the top with enough resources to deflect blame on others beneath them. Until that is fixed, many of us suffer the consequences.

The opinions and analyses that Earl writes are his own and are not necessarily the positions or views of his employers, the agencies he supports, or that of his colleagues. Reach out with comments or questions.