Ryan: Middle-class families will save nearly $1,200 per year under GOP tax plan

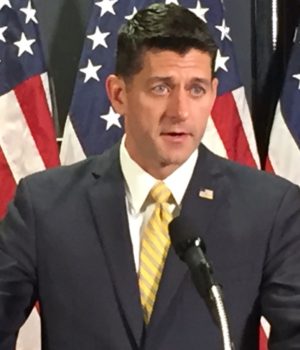

WASHINGTON – House Speaker Paul Ryan (R-Wis.) on Thursday said a middle-class family of four ($59,000 median household income) will save nearly $1,200 a year under the tax reform plan Republican lawmakers crafted in conjunction with the Trump administration.

“With this plan the typical family of four will save $1,182 a year on their taxes,” Ryan said at a news conference in which he and fellow House GOP leaders formally unveiled the legislation.

“For many families having an additional $1,182 more will make a real difference,” the speaker added.

The Tax Cuts and Jobs Act proposes $5.5 trillion in tax cuts over the next decade and constitutes the most comprehensive tax reform package since the Graham-Rudman-Hollings Act of 1986.

The maximum corporate tax rate would be reduced from 35 percent to 20 percent. The existing seven income tax brackets would be consolidated into four.

Pass-through taxation would be reduced from 35 percent to 25 percent and the estate tax would be eliminated.

The child tax credit would increase from $1,000 to $1,600.

State and local property tax deductions would be capped at $10,000 and mortgage home interest deductions would remain capped at $500,000 for newly purchased homes.

Retirement plans are not affected by the legislation nor is taxation on investment income.

Senate Minority Leader Chuck Schumer (D-N.Y.), in a floor speech delivered shortly before the legislation was posted, said the tax plan would disproportionately benefit the wealthy.

“The Republican tax plan would put two thumbs down on a scale already tipped toward the wealthy and powerful,” Schumer said.

“It wouldn’t help create jobs or raise wages.”

Bryan is the managing editor of Baltimore Post-Examiner.

He is an award-winning political journalist who has extensive experience covering Congress and Maryland state government. His work includes coverage of the first election of President Donald Trump, the confirmation hearings of Supreme Court Justice Brett Kavanaugh and attorneys general William Barr and Jeff Sessions, the Maryland General Assembly, Gov. Larry Hogan, and the COVID-19 pandemic.

Bryan has broken stories involving athletic and sexual assault scandals with the Baltimore Post-Examiner.

His original UMBC investigation gained international attention, was featured in People Magazine and he was interviewed by ABC’s “Good Morning America” and local radio stations. Bryan broke subsequent stories documenting UMBC’s omission of a sexual assault on their daily crime log and a federal investigation related to the university’s handling of an alleged sexual assault.