Maryland pension fund earns 14 percent, now valued at $45 billion

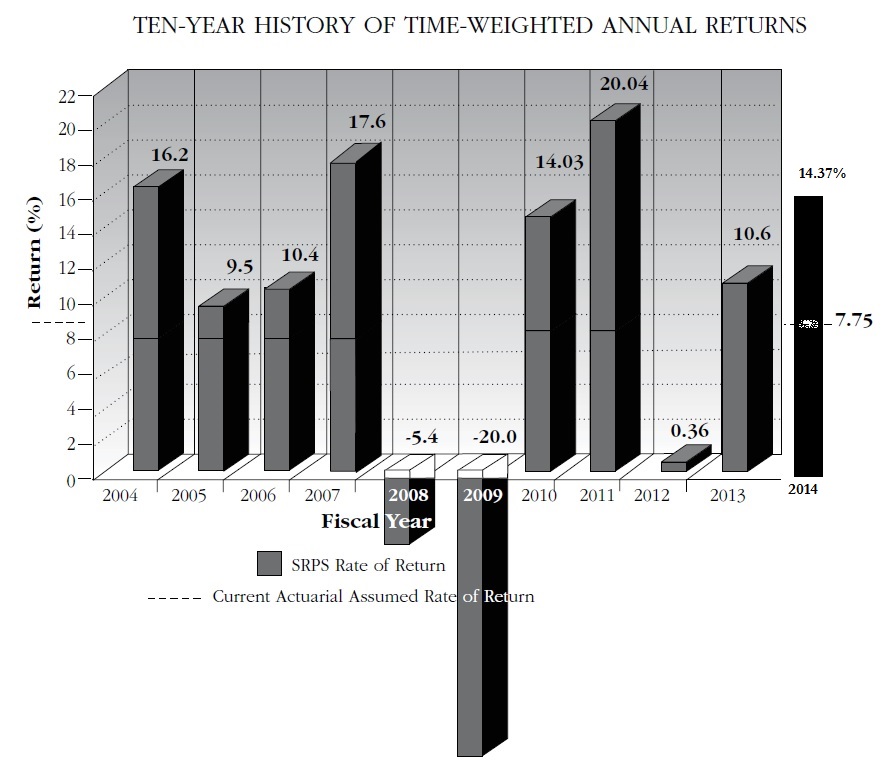

It was the second year in a row of strong performance due to sharp upturns in stocks, according to Chief Investment Officer Melissa Moye. The fund exceeded its target of 7.7 percent and its market benchmark of 14.16 percent — what its basket of assets would have been expected to earn.

The figures were released last Friday. Unlike last year’s report they do not include investment performance by asset category, and it did not list the dollar amount or percentage of unfunded liabilities for the system which covers 244,000 active and retired state employees and teachers and their beneficiaries.

The unfunded liabilities of the pension system — the amount it has promised to pay out in the future minus its current assets — have been about $20 billion. These liabilities are consistently mentioned as a negative financial factor by all three bond rating agencies as they did earlier this month.

But the three New York agencies also note the improvements made in Maryland’s pension outlook after employee contributions were raised and benefits reduced by the legislature in 2011.

“The funds annual returns continue to reflect the strong market environment that has prevailed since the end of the credit crisis,” State Treasurer Nancy Kopp, chair of the pension board, said in a statement.

***GIVE US A FEW MINUTES OF YOUR TIME: To help improve our coverage and provide foundations and advertisers with more information about our readers, will you kindly take a few minutes to fill out our subscriber survey? It is just 12 simple questions and will take less than 5 minutes of your time. We would appreciate it very much. Thank you in advance for helping us.https://www.surveymonkey.com/s/July2014SurveyMarylandReporter***

Source: Maryland State Retirement and Pension System Comprehensive Annual Financial Report with 2014 bar graph added

MarylandReporter.com is a daily news website produced by journalists committed to making state government as open, transparent, accountable and responsive as possible – in deed, not just in promise. We believe the people who pay for this government are entitled to have their money spent in an efficient and effective way, and that they are entitled to keep as much of their hard-earned dollars as they possibly can.