More Md. bond funding in the works

By Len Lazarick

The O’Malley administration on Wednesday successfully pushed to raise next year’s bond authorization to $1.16 billion, $75 million more than this year, rejecting objections by state Comptroller Peter Franchot that “we’re adding another Christmas tree ornament.”

“We can’t afford it,” Franchot told the Capital Debt Affordability Committee, saying it should stick to this year’s bond authorization of $1,085,000,000.

As often happens, Franchot was the lone voice in opposition, and was outvoted 4-1 on the five-member committee that includes the state treasurer and two O’Malley cabinet secretaries.

Budget Secretary Eloise Foster said the move to increase the amount of general obligations for the next five years was justified in order to take advantage of continued low interest rates.

The vote is only a recommendation to the governor and legislature, but they generally follow the committee’s advice.

Extra bond money will help fund projects, jobs

The extra $375 million would “allow the state to fund most of the projects called for in the Capital Improvement Plan as well as accommodating the Watershed Implementation Plan expenses,” Foster said in a memo.

Budget Seccretary Eloise Foster, State Treasurer Nancy Kopp, Comptroller Peter Franchot at a Board of Revenue Estimates meeting

The increased debt was still within the state’s affordability guidelines, which say debt service — annual principal and interest payments on the bonds — can be no higher than 8% of state revenues, and total debt can be no higher than 4% of total personal income in Maryland.

The bond money is generally for construction or maintenance of buildings, roads and transit and will “support the state’s ongoing jobs recovery,” Foster wrote. “Almost eight jobs are created for every one million in construction funding. Therefore, increasing debt levels by $75 million a year will support up to 3,000 jobs over the five year period.”

Jobs and wages were also Franchot’s concern. Last week, the Board of Revenue Estimates, which he chairs and includes Foster and State Treasurer Nancy Kopp, reduced the projections for withholding taxes next year. “Wage growth is almost nonexistent,” Franchot said. “This is not a strong economy.”

Concerns about taxes

Sen. James Ed DeGrange, D-Anne Arundel, co-chair of the legislature’s Spending Affordability Committee, said the Budget and Taxation Committee on which he also serves was concerned that the state’s fund balance (budget surplus) was only $76 million after being estimated at $294 million.

DeGrange, who serves on the debt affordability committee but has no vote, was worried that creating more debt would lead to raising the state property tax, which is dedicated to paying off the state’s bonds.

“I think they’re very valid concerns,” said Franchot, who serves on the three-member Board of Public Works, which sets the state property tax rate.

“I will not vote for a property tax increase,” Franchot said. “The taxpayers of Maryland have had it.”

State Treasurer Nancy Kopp, who chairs the debt affordability committee and serves on the Board of Public works with Franchot and Gov. O’Malley, said she shared the comptroller’s concerns, but not his conclusions. Kopp said the state would still be lower than its affordability guidelines.

The current state property tax rate 11.2 cents per $100 of valuation and it will raise $713 million this year. But total debt service is $983 million, requiring a supplement of over $100 million. The state property tax is one of the few taxes that have not been raised during the O’Malley administration.

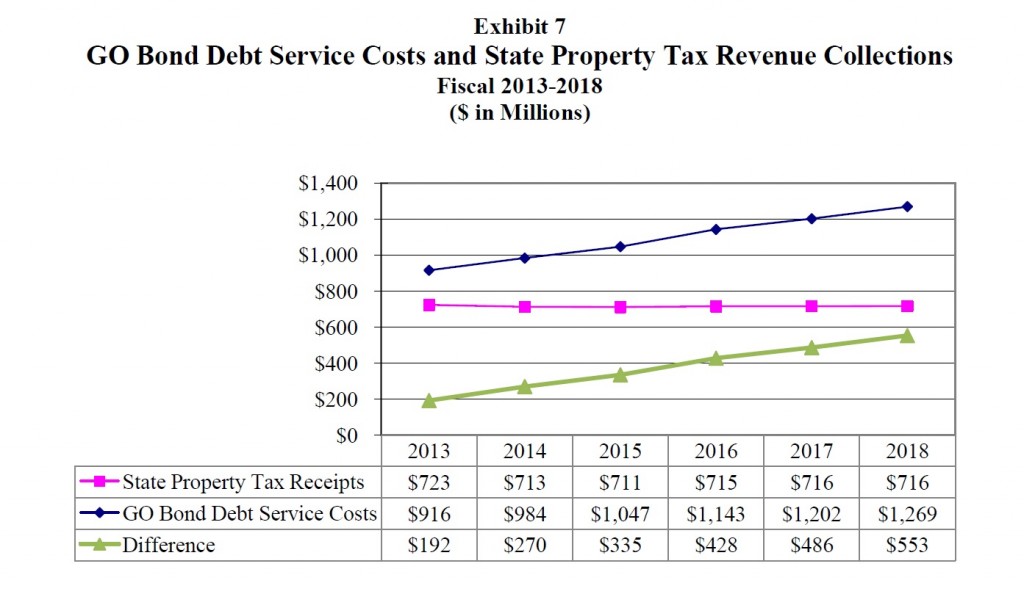

According to the Department of Legislative Services, “Over the next few years, State property tax revenues are estimated to remain fairly flat. This contrasts with debt service costs, which are expected to increase steadily in the out-years. Exhibit 7 (below) shows how State property taxes, which are $192 million less than debt service costs in fiscal 2013, are expected to be $553 million less than debt service costs in fiscal 2018.”

Paul Meritt, a bank executive who is the public representative on the debt affordability committee and its longest serving member, voted for the increased bond authorization.

Paul Meritt, a bank executive who is the public representative on the debt affordability committee and its longest serving member, voted for the increased bond authorization.

“Building costs don’t go down,” said Meritt, who rarely speaks at meetings and doesn’t like to be quoted. There’s an old saying in the investment business, he said. “The best time to invest your money is when you have it.”

MarylandReporter.com is a daily news website produced by journalists committed to making state government as open, transparent, accountable and responsive as possible – in deed, not just in promise. We believe the people who pay for this government are entitled to have their money spent in an efficient and effective way, and that they are entitled to keep as much of their hard-earned dollars as they possibly can.