County administrator finds fault with pension map, commentary

By Ken Decker

County Administrator, Caroline County

I appreciate Carol Park’s nod to Caroline County in her Aug. 8 commentary in MarylandReporter.com about local government pensions (Pension map shows counties have liabilities too.). Unfortunately, in the rush to the Maryland Public Policy Institute’s talking points, there are some missteps

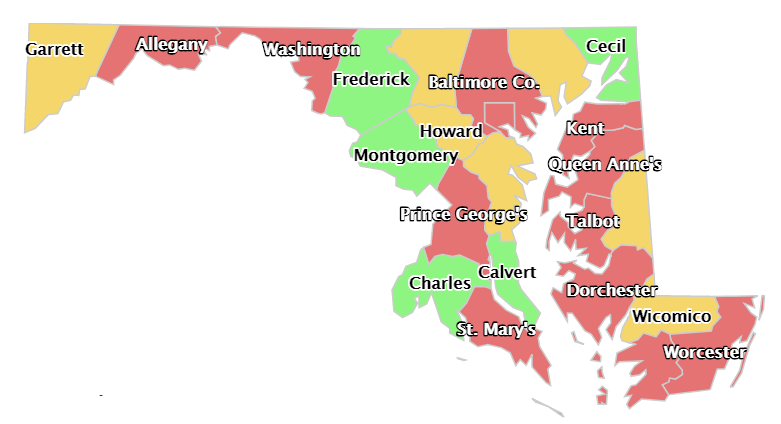

Let’s start with the map showing how “local” government pensions are funded. I use quotations for a reason. It’s easy to see that several of the counties have the same funding ratio. This isn’t a statistical anomaly; it’s because those counties participate in the State of Maryland’s pension system, not locally funded and managed plans.

The red ink on the MPPI’s map proves the point I made on MarylandReporter.com in 2017. Some local governments in Maryland (like Caroline County) are doing a much better job than the state legislature in addressing unfunded liabilities like pensions and retiree healthcare.

Misleading map

The MPPI map is misleading for another reason. A pension’s funding ratio rests on numerous assumptions. One of the most important is expected investment returns. For example, Caroline’s funding ratio improved while lowering the expected rate of investment return from 7.5% to 7.1%. For actuaries and other people who do math, that’s kind of a big deal. It’s also why our local pension fund is in better financial shape than suggested by the MPPI map and why the State of Maryland’s is worse.

Another element missing from the MPPI analysis is context. Since the Great Recession, the legislature has balanced the state’s budgets largely on the backs of local government. Caroline made progress on its pension and retiree healthcare funding despite draconian cuts in state funding, seemingly endless unfunded mandates, and the innocuous sounding “cost shifting.”

These are points I would have made had someone from MPPI called me. I realize the telephone has become a legacy technology, but Google searches and cutting-and-pasting financial documents are not the same as analysis.

A deeper look into the problem of underfunded pensions reveals that local governments like Caroline County have found ways to make progress despite incredible structural challenges.

There’s no question the public pension crisis is real. We owe the taxpaying public—and a generation of public employees who are counting on pensions—more than yet another ringing of the warning bell or a distressing shallow recitation of numbers. We owe them answers and actions that will allow public pensions to fulfill their promises without bankrupting state and local governments.

MarylandReporter.com is a daily news website produced by journalists committed to making state government as open, transparent, accountable and responsive as possible – in deed, not just in promise. We believe the people who pay for this government are entitled to have their money spent in an efficient and effective way, and that they are entitled to keep as much of their hard-earned dollars as they possibly can.