Assembly leaders back cutting estate taxes, but opponents knock break for wealthy

By Jeremy Bauer-Wolf

General Assembly leaders say they are fearful wealthy Maryland residents are moving out of state because of Maryland’s high estate tax and are promoting legislation that would cut the “death tax”

Maryland imposes a tax when property is transferred from the deceased to a living relative, if that property is valued at more than $1 million — the tax caps at 16% of the entire estate.

Senate President Mike Miller is one of the lawmakers spearheading legislation — along with House Speaker Michael Busch — that would reduce the death tax. Miller said he wants to recouple it to the federal limits, matching the federal exclusion level of $5.3 million.

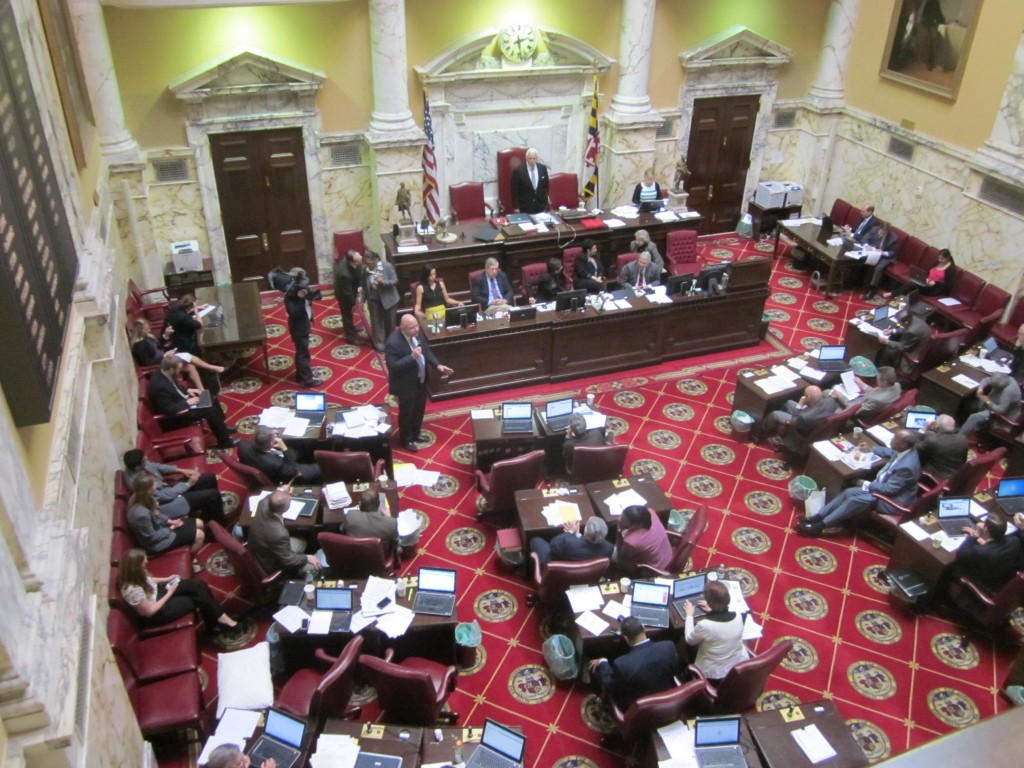

Miller testified on his bill, SB 602, to the Senate Budget and Taxation Committee Wednesday. Maryland citizens ages 55 and older, one of the wealthiest sectors of the state, he said, are “fleeing” to Virginia, Delaware, Florida to avoid being taxed.

Competition from other states

“Our fiercest competition is our sister states,” he said.

The bill is co-sponsored by two-thirds of the Senate, including seven of 12 Republicans and 10 of the 13 committee members.

In the House, Busch rounded up 56 co-sponsors, including most of the leadership but no Republicans. The House version of the bill, HB 739, was also heard Wednesday in the House Ways & Means Committee.

Thirty-four states do not apply an estate tax. Maryland and New Jersey are the only two states that tax both the deceased’s estate and any assets given to heirs.

Sen. Jennie Forehand, D-Montgomery, one of the bill’s 33 sponsors, said she knows of Marylanders who are taking residence in their summer homes — on paper, they’re residents of another state, but stil spend much of their time in Maryland — simply to avoid the high taxes.

“Our older citizens who have worked so hard to be successful deserve to leave more to their heirs,” she said.

Sen. Richard Madaleno D-Montgomery, one of the few opponents of the bill on the Budget & Tax Committee, questioned whether residents cross state lines solely because of the estate tax, or whether other factors were more pertinent, such as a better climate, particularly with the harsh winter Maryland has endured.

The Department of Legislative Services estimated lost tax revenue of $28 million in fiscal year 2015, eventually reaching a loss of $137 million by fiscal 2019. This decline was of particular concern to the bill’s opponents. The bill’s raises the exclusion of estate assets gradually — to $1.7 million in 2014, $2.7 million in 2015, $3.5 million in 2016, and fully to the federal level by 2017.

Poll backs taxing the wealthy

“It’s difficult to understand why any lawmaker would cast a vote to consider cutting taxes from some of the wealthiest in Maryland,” Kate Planco Waybright, executive director of Progressive Maryland.

Waybright’s organization commissioned a poll from Public Policy Polling that showed 61% of Democrats oppose the higher exclusions, while 31% favor it — a 2-to-1 margin.

“If you have to want innovation in your economy, you have to pay for it,” said Richard Phillips, research analyst for Citizens for Tax Justice. “You have to pay for the universities, you have to pay for the education. The estate tax contributes millions of dollars to pay for these things.”

The death taxes will raise an estimated $203 million this year, less than 1% of overall state revenues.

MarylandReporter.com is a daily news website produced by journalists committed to making state government as open, transparent, accountable and responsive as possible – in deed, not just in promise. We believe the people who pay for this government are entitled to have their money spent in an efficient and effective way, and that they are entitled to keep as much of their hard-earned dollars as they possibly can.